Introduction: Why Zeta Is on Investors’ Radars

In today’s market, it is rare to find a company that is delivering standout financial results while its stock price tells a completely different story. This is the exact situation with Zeta Global (ticker: ZETA), and it’s why the company is squarely on investors’ radars right now.

On the one hand, the company is performing exceptionally well. Zeta Global just delivered a stellar first quarter for 2025, with several key highlights:

- Rapid Revenue Growth: Sales grew by an impressive 36% year-over-year, reaching $264 million.

- Improving Profitability: Its EBITDA margin expanded to 17.7%.

- Strong Cash Generation: Free cash flow surged by an incredible 87% compared to the year before. Furthermore, the company is so confident in its performance that it has raised its financial guidance for the full year.

On the other hand, the stock price has fallen significantly. Despite these strong operating results, Zeta’s stock currently trades around $15, which is nearly 60% below its 52-week high of about $38.

The Core Question for Investors

This major disconnect between the company’s performance and its stock price raises a critical question: Is Wall Street overlooking a powerful, AI-driven growth story, or does the discounted price reflect justified concerns?

There are valid arguments on both sides. The company has a consistent track record of beating expectations and is a leader in the AI marketing space. However, it is not yet profitable on a GAAP basis, and investors have lingering concerns about factors like share dilution from stock-based compensation.

Therefore, the rest of this newsletter will dive deeper into Zeta’s strategy, financials, and competitive advantages to determine whether this valuation gap represents a major opportunity or a hidden risk.

Strategy & Competitive Moat: The All-in-One AI Marketing Cloud

Now that we understand the disconnect between Zeta’s performance and its stock price, let’s look at its core strategy. The company’s vision is to solve the biggest problems facing modern marketers: scattered data, a lack of technical skills, and the difficulty of using AI effectively.

The Core Strategy: A Unified Data and AI Platform

Zeta’s entire strategy is built around its unified AI marketing cloud. Instead of forcing marketers to stitch together a dozen different tools, Zeta provides a single, all-in-one platform.

This platform does two key things:

- It Gathers and Cleans Data: Zeta has one of the world’s largest proprietary data sets, with information on over 245 million consumers. It pulls all of this data together, creating a single source of truth for marketers. This solves the huge problem of “data silos” where customer information is scattered across different, disconnected systems.

- It Uses AI to Automate Marketing: The platform features powerful tools like the AI Agent Studio and Zeta Answers. In simple terms, these tools allow marketers to build and use AI “bots” to automate everything from personalizing customer messages to optimizing entire advertising campaigns in real-time.

As a result, Zeta’s platform helps companies run more effective marketing campaigns with less manual effort, which improves productivity and return on investment (ROI).

Zeta’s Competitive Moat: What Sets It Apart?

This strategy creates a strong competitive “moat”—a set of advantages that are difficult for competitors to copy. The user even provided a table which I am using in this section.

| Moat Element | Zeta’s Advantage |

| Massive Data Scale | One of the world’s largest private data sets (245M+ consumers, 1 trillion monthly signals). |

| AI-Driven Automation | Customizable AI agents that automate complex marketing tasks from start to finish. |

| Execution Simplicity | A single platform that combines customer data, intelligence, and marketing activation. |

| High-Value Clients | A growing base of large clients who spend more each year, with average revenue per user up 23%. |

| High Switching Costs | The deep integration of Zeta’s platform into a client’s daily workflow makes it very difficult and costly for them to leave. |

In conclusion, Zeta’s competitive advantage is its powerful combination of a massive, unique data set with an easy-to-use AI platform that automates complex work. This all-in-one solution gives Zeta a clear edge over competitors who only offer partial or more complicated tools, especially as marketers look for efficiency, compliance, and provable results.

How Zeta Makes Money: Sources of Revenue & Market Coverage

To understand Zeta’s business, it’s important to look at where its money comes from. The company has successfully built a business model that is focused on high-quality, predictable revenue streams.

A Focus on High-Quality, Recurring Revenue

The vast majority of Zeta’s income comes from platform-direct Annual Recurring Revenue (ARR). In simple terms, this means customers pay a predictable, subscription-style fee to use its core AI-powered marketing platform. This is the most attractive type of revenue for investors because it is stable and highly visible.

This strategy is clearly working and accelerating.

- In the first quarter of 2025, total revenue grew by an impressive 36% year-over-year to $264 million.

- Even more importantly, this high-quality platform revenue now makes up 73% of the company’s total sales, up from 67% just a year ago. This shows a successful shift away from lower-margin, one-time services.

Serving a Broad and Diverse Market

Zeta’s platform is designed to serve a wide range of customers, which diversifies its business and creates multiple avenues for growth.

First, the company is successfully moving upmarket. Zeta is attracting more and more large, high-value clients. For instance, the number of “Super-Scaled” customers (those who spend over $1 million per year) grew by 10%. Furthermore, the average revenue from these top clients (ARPU) jumped by an incredible 23% to $1.38 million, showing that once large companies start using the platform, they spend more and more over time.

At the same time, Zeta serves clients of all sizes. While its top clients are growing, the company’s platform is also used by thousands of small and medium-sized businesses. In addition, its customer base is spread across many different industries, including retail, insurance, and financial services, and across multiple regions, including North America, Europe, and Asia.

In conclusion, Zeta’s revenue model is becoming stronger and more predictable every quarter. The company’s successful shift to platform-direct recurring revenue, combined with its ability to attract and grow with high-value customers across the globe, positions it for durable and diversified growth.

Of course. Based on this detailed information, here is the next section of the newsletter, focusing on Zeta’s markets and diversification strategy.

Markets and Diversification: Multiple Levers for Growth

Zeta Global’s growth isn’t just coming from one place. The company has a well-diversified strategy that spreads across different geographies and industries. Furthermore, it is perfectly positioned to benefit from some of the most powerful trends in the technology world today.

A Global Footprint with Room to Grow

First of all, the company has a strong geographic focus on North America, which currently drives the majority of its revenue. However, Zeta is actively expanding its presence in both Europe and Asia-Pacific. These international markets are seeing rising demand for data-driven marketing tools, and the Asia-Pacific region, in particular, is expected to be a major source of future growth.

In addition to its geographic reach, Zeta’s platform is used across a wide variety of industries, including:

- Retail

- Finance and Insurance

- Telecommunications

- Healthcare

This industry diversification is a key strength. For instance, it reduces the company’s risk by not being dependent on a single sector and allows it to benefit from digital transformation trends happening across the entire economy.

Powerful Market Trends Fueling Demand

Beyond its own strategy, Zeta is being pushed forward by major market tailwinds.

The first major trend is tightening privacy regulations. New laws like GDPR in Europe and CPRA in California are forcing companies to be much more careful with how they handle customer data. Zeta’s platform, which helps companies use their own first-party data in a secure and compliant way, is the perfect solution for this new reality.

Secondly, the widespread adoption of the cloud and AI is a direct benefit to Zeta’s business model. As more companies move their operations to the cloud and invest in AI-powered marketing, they need exactly the kind of tools that Zeta provides.

Contracts, Alliances, and Recent News

A key part of Zeta Global’s strategy is to grow by working with other major technology companies. By forming smart partnerships and making strategic acquisitions, the company is expanding its reach and making its platform more powerful and integrated for its customers.

Deep Partnerships with Cloud Giants

First and foremost, Zeta has built strategic integration partnerships with the world’s leading cloud platforms, including Snowflake, Amazon Web Services (AWS), and Microsoft Azure.

What this means in simple terms is that Zeta’s platform works seamlessly with the tools that large companies already use every day. For example, its collaboration with Snowflake allows clients to securely combine their own data with Zeta’s insights, leading to much more effective and privacy-compliant marketing campaigns. These partnerships make it very easy for large enterprises to adopt and use Zeta’s technology.

A Major Acquisition to Boost Data Capabilities

In addition to these partnerships, Zeta recently made a major strategic move by acquiring the company LiveIntent for $350 million.

This was a very important acquisition because LiveIntent brings a huge amount of valuable data, especially from consented email lists. The main benefit is that this enhances Zeta’s ability to offer personalized marketing across many different channels and strengthens its position in a world that is moving away from third-party cookies and toward first-party data.

An Evolution in Leadership

Finally, the company is also evolving at the executive level. Co-founder John Sculley (formerly the CEO of Apple) recently retired from the company. This marks a natural transition for Zeta as it continues to grow and scale under its current leadership team.

In conclusion, through its deep cloud integrations, channel partners, and smart acquisitions like LiveIntent, Zeta is aggressively building its scale and capabilities. These alliances are a key part of its strategy to embed its AI marketing platform into the core workflows of major enterprises around the world.

What Makes Zeta Stand Out? (Its Key Competitive Advantages)

Zeta Global’s competitive “moat” is built on four key pillars that are difficult for competitors to replicate:

An Aligned Ownership Structure: With significant insider (~13%) and institutional (~88%) ownership, the company’s management is strongly aligned with creating long-term value for shareholders.

A Massive Proprietary Data Set: Its “identity graph” on 245 million US consumers, processing over a trillion monthly signals, creates a data advantage that is nearly impossible for others to copy.

An “AI-First” Automation Platform: The platform was built for artificial intelligence, allowing clients to automate complex marketing campaigns for faster results and a higher return on investment (ROI).

A “Sticky” Recurring Revenue Model: The company has very high customer retention because its platform becomes deeply integrated into a client’s daily operations, creating high switching costs.

Financial Performance & Valuation

A company’s strategy is only as good as its financial results. In Zeta’s case, the numbers show a powerful story of rapid top-line growth, improving profitability, and strong cash generation.

Of course. Here is a financial highlights table with the key metrics you requested.

This table can be added to the “Financial Performance & Valuation” section of the newsletter to give readers a quick, scannable overview of the most important data.

Financial Highlights Table

This table provides a snapshot of Zeta Global’s key financial metrics, reflecting its current valuation, performance, and growth trends.

| Metric | Value |

| Stock Price | ~$15.40 |

| Market Cap | ~$3.12 Billion |

| Revenue (TTM¹) | $1.075 Billion |

| Net Income Growth (2020-2024) | From -$242 Million to -$52 Million |

| Forward P/E Ratio² | ~22.78x |

| Operating Income Growth (2020-2024) | Improved from -$27Mto -$98M |

| Investing Cash Flow (TTM¹) | -$73.2 Million |

| Return on Assets (ROA) Growth (2020-2024) | Improved from -45% to -3% |

| Return on Equity (ROE) Growth (2020-2024) | Improved from -255% to -11% |

A Story of Rapid and Consistent Growth

Zeta has an impressive and consistent track record of growth. In fact, the company has now delivered 15 consecutive quarters where it has beaten financial expectations and raised its guidance for the future.

Let’s look at the recent numbers:

- Full Year 2024: Revenue grew by a very strong 38% to reach $1.01 billion.

- First Quarter 2025: The momentum continued with revenue reaching $264 million, up 36% compared to the same quarter last year.

Furthermore, the quality of this revenue is improving. High-margin, recurring platform revenue now makes up 73% of the company’s total sales.

The Clear Path to Profitability

While the company has historically had net losses, the financial picture is rapidly improving, and it is now generating significant cash.

- Improving Margins: The company’s adjusted EBITDA margin has expanded to 17.7%, showing that the business is becoming more efficient as it grows.

- Surging Cash Flow: Most importantly, Free Cash Flow surged by 87% in the first quarter to reach $28 million. This shows the company is now generating a healthy amount of cash, which it can use to invest in growth or even buy back its own stock.

- The Net Loss Explained: Zeta is still not profitable on a GAAP basis (the standard accounting method), reporting a net loss of $22 million in Q1. However, this loss was primarily caused by $42 million in non-cash, stock-based compensation. Without this, the company would be solidly profitable.

Current Valuation and Analyst Outlook

This is where the story gets very interesting for investors. Despite its strong performance, Zeta’s stock appears attractively valued.

- Valuation Multiples: The company trades at a Price-to-Sales (P/S) ratio of around 3.3x. This is a very reasonable multiple compared to many of its peers in the software industry, which can trade at multiples ranging from 3x to over 15x.

- Analyst View: Wall Street analysts are very bullish on the stock. The consensus rating is a “Strong Buy” with an average 12-month price target between $28 and $33. This implies a potential upside of approximately 90% from the current price.

In conclusion, Zeta’s financials show a business that is successfully combining high growth with improving operational efficiency. The company is now generating significant free cash flow, and its valuation appears modest compared to its performance and the positive outlook from financial analysts.

The Investment Thesis: Opportunities vs. Risks

Zeta Global presents a classic high-growth story with a clear opposition between its future potential and its current risks. Let’s break down both sides of the investment case.

The Opportunities (The Bull Case)

First, the company has a clear and ambitious plan for growth. Zeta’s “Zeta 2028” plan targets annual revenue of over $2 billion by 2028. This would require a very strong growth rate of 20-40% per year, driven by the powerful “flywheel effect” of its AI platform—more data leads to smarter AI, which delivers better results for clients and attracts more customers.

Second, there is a major valuation disconnect. The stock currently trades at a steep discount to many of its software-as-a-service (SaaS) peers, based on its EV/Sales ratio. This means its low valuation makes it an attractive acquisition target for a larger company or private equity fund.

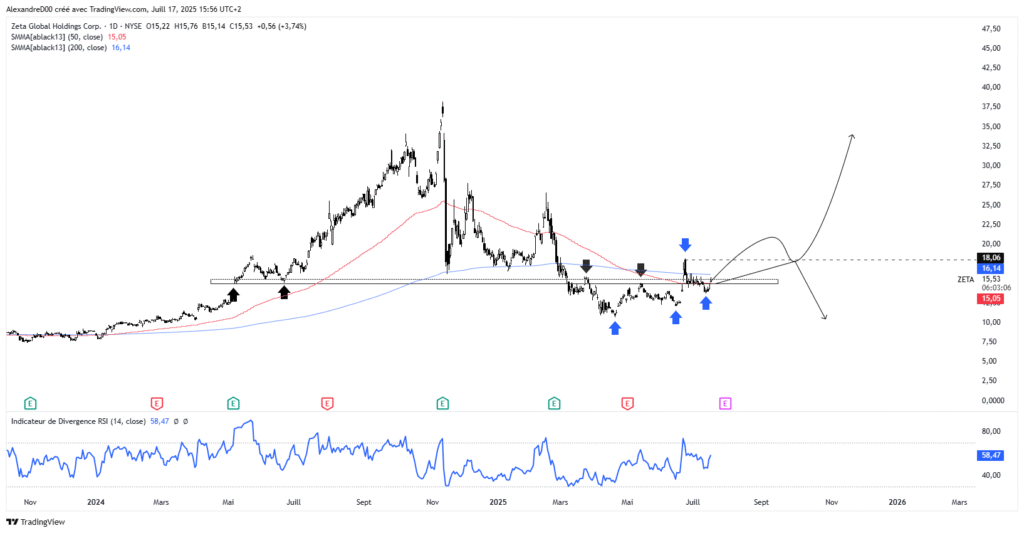

Furthermore, the technical chart is showing signs of a potential turnaround. The stock is down about 60% from its historical highs, but it has rebounded +19% in the last three months. It is currently forming a “descending wedge” pattern around the $14–$15 price level. For chart analysts, a breakout above the ~$18 resistance level would be a very bullish signal, potentially sparking a rally of +50% or more.

The Risks to Watch (The Bear Case)

However, it is crucial to understand the significant risks.

The biggest threat is intense competition. Zeta faces strong competition from technology giants like Salesforce, Adobe, and Oracle. These massive companies have huge resources and could put pressure on Zeta’s pricing and market share.

In addition, there are valuation concerns. While the company looks cheap on some metrics, its high PEG and P/B ratios could be a warning sign of overvaluation in certain areas, especially if growth were to slow down.

Finally, there are ongoing risks to consider. The company has faced securities lawsuits in the past, and any future legal or regulatory issues related to data privacy could create an overhang on the stock. Also, a failure of the technical chart pattern to break out could see the stock re-test its lower support levels around $10.

In summary, Zeta’s future offers substantial long-term upside, driven by its unique AI engine and ambitious growth targets. But at the same time, the risks from competition and its current profitability status mean that the company must execute its plan flawlessly to succeed.

Conclusion and Investment Verdict

After a deep dive into Zeta Global’s strategy, financials, and the risks and opportunities it faces, we can now draw a clear conclusion.

Zeta Global stands out as an underappreciated AI and data powerhouse in the marketing technology sector. Its key advantage is its unique and massive data set combined with a powerful AI platform, which creates a strong competitive moat. As a result, the company is delivering powerful recurring revenue growth, keeping its customers loyal, and is on a clear path toward sustainable profitability, as shown by its rapidly improving free cash flow.

However, despite this strong operational performance, the stock trades at a significant valuation discount to its peers. With an EV/Sales ratio around 3.3x, it is far cheaper than giants like Adobe or Salesforce. This discount seems to be more about general market skepticism towards the sector than about Zeta’s actual business fundamentals.

That said, the risks should not be ignored. Zeta operates in a fiercely competitive space, is not yet profitable on a GAAP basis, and has some legal and regulatory overhangs.

Final Investment Verdict & Recommendation

For growth-oriented investors, Zeta Global presents a rare opportunity to own a category-defining AI marketing platform while it still trades at a substantial discount. The risk/reward profile appears highly favorable for those with a long-term view.

- Recommendation: Buy

- Entry Point: We recommend buying on weakness in the $14–$15 range.

- Price Target: Our 12–18 month price target is $28–$30, representing nearly double the current valuation.

- Suitable For: This investment is best suited for investors who are comfortable with moderate risk and the volatility of the technology sector.

What to Watch Next: The next critical catalysts to monitor will be the upcoming Q2 earnings report at the end of July, any news related to M&A, and further evidence of accelerating adoption of its AI platform. Zeta’s inflection point seems to be happening now, offering an attractive entry for investors seeking high growth from the AI transformation in marketing.

This analysis is for informational purposes only and does not constitute investment advice.