Ticker: $SRPT

Sector: Biotech – Gene Therapy

Market Cap: ~$4.7B

Price (July 2025): ~$14.08

Sarepta Therapeutics (SRPT): Gene Therapy Momentum Fueling Rerating?

As of July 2025, Sarepta Therapeutics (NASDAQ: SRPT) is up approximately +25% year-to-date, significantly outperforming biotech indices. This rally reflects renewed investor confidence in the company’s gene therapy platform, particularly following updates to its pivotal Duchenne Muscular Dystrophy (DMD) program. Key drivers include supportive early regulatory commentary, promising trial data, and strong analyst coverage.

The central investment question today:

Is Sarepta’s growth sustainable, or already priced in?

Market Context – Duchenne Muscular Dystrophy (DMD) as Primary Value Driver

- DMD is a rare, fatal muscle-wasting disease primarily affecting boys (≈1 in 5,000 male births). Most patients lose ambulation by their teens and die prematurely due to respiratory or cardiac complications.

- The global DMD therapeutics market is expected to exceed $20 billion by 2030, driven by increasing diagnosis and emerging gene therapy solutions.

- Sarepta’s flagship product, SRP-9001 (delandistrogene moxeparvovec), is a next-generation micro-dystrophin gene therapy, designed to compensate for the defective dystrophin protein in DMD.

Competitive Landscape

Sarepta faces growing competition from gene therapy newcomers, including companies like Pfizer (PF-06939926) and Solid Biosciences. However, Sarepta’s head start in pivotal data collection and regulatory interaction may provide a crucial first-mover advantage.

Strategic Direction & Pipeline Overview

Sarepta’s strategy is now focused on gene therapy dominance in neuromuscular diseases, anchored by three core therapies:

- SRP-9001 – Lead gene therapy candidate in ongoing global regulatory review, targeting ambulatory DMD patients.

- SRP-6004 & SRP-9004 – Early to mid-stage programs focused on non-ambulatory DMD patients, a large untapped subpopulation.

- The company is also exploring pipeline expansion into additional rare neuromuscular conditions, creating multi-indication optionality.

Key Upcoming Catalysts

| Catalyst | Expected Timing |

|---|---|

| FDA BLA (Biologics License App.) decision | Q4 2025 – Q1 2026 |

| EMA (European) regulatory review | Ongoing – Possible 2026 CE Mark |

| Phase III interim/topline readouts | H2 2025 – H1 2026 |

| Non-ambulatory DMD trial updates | 2026+ |

Financial Position – Healthy Runway Enables Clinical Execution

| Metric | Value |

| Market Cap | $1.38B |

| Stock Price | $14.08 |

| Revenue | $2.23B |

| Net Income | -$250M |

| Profit Margin | -11,12% |

| Net Cash | -$833M |

| Debt Equity Ratio | 1.19 |

| ROA | -2,19% |

| ROE | -23,61% |

Revenue Growth, Elusive Profitability

- Consistent revenue growth has been a highlight for Sarepta over the past 5 years, showing the company’s ability to expand its commercial reach and product portfolio.

- Net income does not follow this upward trend—the company remains structurally unprofitable, with an annual loss of $250M this year.

- Profit margin has shown a slight improvement in recent years, even turning positive last year, but has quickly reverted to a significant negative (-11.12%) this year, suggesting operational challenges or a non-recurring positive event in the prior period.

Cash, Debt and Liquidity Stress

- Net cash position is deeply negative (-$833M), indicating that Sarepta’s available cash and equivalents are significantly outweighed by its total debt obligations.

- The Debt/Equity ratio is rising (1.19)—a sign that the company’s reliance on debt is increasing, with leverage now above the typical sector comfort zone.

- This evolution points to deteriorating financial flexibility: for the first time, Sarepta’s cash flow no longer comfortably sustains its debt load, raising concerns about refinancing risk or the need to sell non-core assets to shore up liquidity.

- Recent trends also show that after aggressive investment cycles three years ago, the company has been selling off assets, likely to reduce its debt burden.

Management Efficiency & Profitability Ratios

- Return on Equity (-23.61%) and Return on Assets (-2.19%) are both negative, highlighting inefficient capital use and persistent losses. This stands out when compared to profitable biotech peers, where such ratios typically turn positive as products gain traction.

- Financial stewardship remains unclear: while Sarepta is growing top-line revenue, this has not translated into sustained profitability or improved capital returns.

- Investors should note the divergence between revenue scale-up and ongoing margin/composition challenges.

Summary & Outlook

Sarepta is a biotech leader with robust revenue growth, but the financial foundation is increasingly fragile. The company is wrestling with persistent losses, rising debt, and negative returns for shareholders. Asset sales may temporarily ease pressure, but the success of management’s current strategy will depend on either achieving durable profitability or attracting strategic capital/partnerships.

Valuation Metrics vs Peers

Sarepta currently trades at a Price-to-Sales (P/S) ratio of ~6x and EV/Revenue of ~5x, placing it at the higher end of biotech valuations. This pricing reflects investor expectations for regulatory success and eventual commercialization of SRP-9001.

| Peer Company | EV/Revenue | P/S Ratio | Notes |

|---|---|---|---|

| Sarepta (SRPT) | ~5× | ~6× | DMD gene therapy leader |

| PTC Therapeutics | ~4–5× | ~5× | DMD (non-gene therapy), exon skipping |

| AveXis (Novartis) | n/a (acquired) | n/a | Gene therapy (SMA-focused) |

Analyst Coverage & Technical Outlook

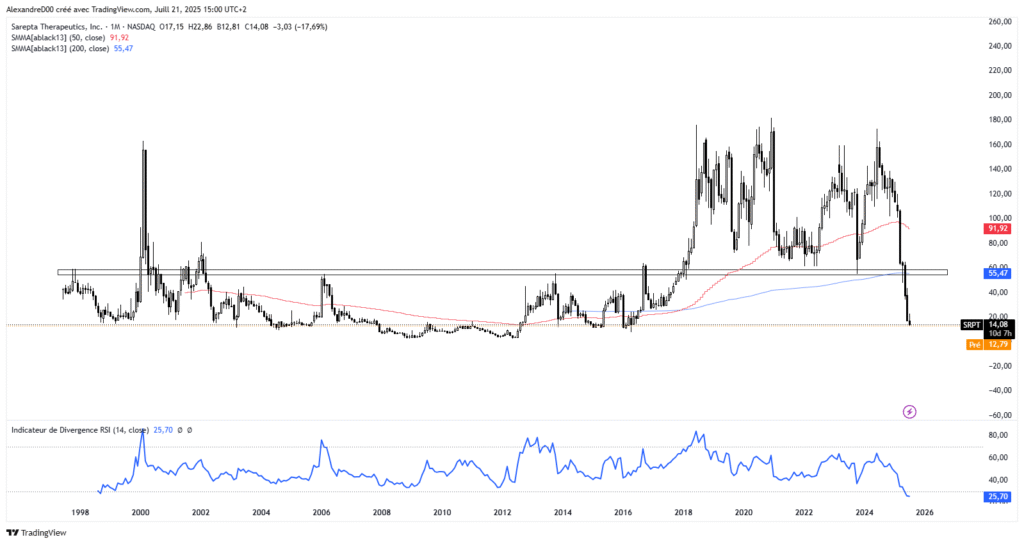

Sarepta’s stock has experienced a dramatic decline in 2025. After starting the year above $120, SRPT collapsed to $14.07 as of July 18, 2025—an annual drop exceeding 88%. Notably, the stock is now testing support levels unseen since 2018, marking a return to long-term lows that had previously acted as a base for the late 2010s rally.

This breakdown is technically significant:

- Price action has breached both the 50-day and 200-day Simple Moving Median Averages (SMMA), signaling not just short-term, but also severe long-term weakness, and confirming a prolonged bearish trend.

- The current price is well below every major technical support, reflecting sustained selling pressure and broken investor confidence.

- Volatility and volume have surged, with frequent new lows and no clear bottoming signal as of mid-July.

For perspective:

- The previous structural support zone was in the $14–$20 range, tested during the 2018–2019 sideways phase. The retest of this zone could bring stabilization attempts—or, if breached, expose the stock to even lower levels not seen in more than a decade.

- Momentum and moving averages: SRPT is now decisively below both its mid- and long-term moving averages, confirming bears remain in control.

Key takeaway: Sarepta is in a technically oversold condition, but no rebound signal has emerged. Investors seeking entries should wait for a credible reversal pattern or recovery of long-term moving averages, as the breakdown below historic SMMA 50 and 200 levels is often a precursor to extended base-building—or further downside if macro or company-specific news disappoints.

This provides both strategic clarity and precise reference points for financial readers and investors

Opportunities vs. Risks

Opportunities

- Growth: Four approved therapies and expanding indications create a sizable commercial base.

- Pipeline milestones: Positive results from regulatory reviews, new partnerships, or breakthrough clinical data could revive sentiment.

- Analyst Targets: Some analysts retain bullish long-term targets ($70–$209/share).

Risks

- Financial fragility: Deteriorating cash position and rising debt increase Sarepta’s sensitivity to negative surprises.

- Profitability: Operating losses, high R&D commitments, and missed EPS targets suggest the revenue boom isn’t translating to the bottom line.

- Regulatory/Operational: Gene therapy safety concerns, administrative/process delays, and new competition all threaten Sarepta’s mid-term outlook

Investment Thesis & What to Watch

Sarepta still commands a leadership position in DMD gene therapy and rare disease, backed by robust revenue growth and a maturing pipeline. However, persistent losses, increasing leverage, and uncertain profitability mean the stock is best suited for risk-tolerant, event-driven biotech investors.

Key Dates & Catalysts

- Q2 earnings (early August) will provide an updated financial snapshot.

- Regulatory updates (BLA, EMA), and ongoing trial results are essential for any rerating.

- Watch for asset sales, restructuring news, or new funding initiatives as Sarepta seeks to balance innovation and financial resilience.

Conclusion

In conclusion, the investment case for Sarepta is a study in contrasts. On one hand, you have a pioneering company with a leading drug candidate in a multi-billion-dollar market. On the other, a fragile balance sheet and a valuation that already assumes success. While the scientific potential is undeniable, investors must weigh it against the clear financial and regulatory hurdles. A position in SRPT requires not just a belief in the science, but a clear-eyed understanding of the fundamental risks involved.