Company Overview — Root, Inc. (ROOT)

- Ticker: ROOT

- Exchange: NASDAQ

- Sector: Fintech / Insurtech

- Founded: 2015; IPO in 2020

- Headquarters: Columbus, OH, USA

- Core Business: Technology-first auto insurance provider

What Sets ROOT Apart:

Root, Inc. was founded to disrupt the centuries-old auto insurance industry by utilizing telematics and advanced behavioral data, rather than relying solely on traditional demographic factors. The company delivers insurance via a 100% mobile platform, using smartphone sensors to monitor how customers actually drive—enabling more precise, personalized premium pricing.

Core Offering:

App-based auto policies, tailored by each user’s driving habits, with a simple, transparent purchase and claims process.

Target Market:

Digitally native drivers, especially Millennials and Gen Z, looking for convenience, fairness, and transparency in insurance pricing.

Business Model & Strategy

How ROOT Makes Money

- Primary Revenue: Auto insurance premiums (and in the future, potentially renters/life products).

- Distribution Channel:

- Direct-to-consumer via a mobile app.

- Embedded insurance: partnerships with car dealerships, original equipment manufacturers (OEMs), and rental networks.

Differentiators

- Underwriting Innovation:

ROOT leverages telematics (real-time driving data collected via smartphone sensors) and proprietary machine learning algorithms to assess and price risk at a granular level. This enables ROOT to offer premiums directly based on observed driving behavior—accelerating, braking, speeding, mileage, etc.—which can differentiate “safe” drivers regardless of age or zip code. - Tech Platform:

- Mobile-first software for both onboarding and claims.

- Continual AI-driven risk scoring and dynamic pricing updates.

- Advanced automation in claims and customer service.

Strategic Focus and Evolution

- Profitability Over Growth:

Recent years have seen ROOT pivot from aggressive “land grab” marketing to disciplined profitability—a focus on tightening loss ratios, cutting back unprofitable business, and investing in the core model’s scalability. - Channel Expansion:

Ramping up embedded/partnered insurance offerings (e.g., bundling policies at point-of-sale with car dealers or big auto retailers) to lower customer acquisition cost and accelerate scalable growth. - Data & Tech Competitive Edge:

ROOT’s large, proprietary datasets on real-world driver behavior and claims outcomes provide defensible tech IP and a potential advantage over legacy insurers and other insurtech startups. - Product Pipeline:

While auto remains the anchor, discussions continue around extending into adjacent insurance verticals (renters, life insurance) as the tech and data platform matures.

Recent Strategic Shifts

- Shrinking exposure in volatile or loss-heavy states and focusing resources on markets with better unit economics.

- Upgraded model efficiency, with loss ratio improvement (to 58% in latest quarter) driving a swing to profitability and cash runway confidence.

- Noticeable increased interest in partnership distribution, setting ROOT up as a potential acquisition target or major embedded insurance solution as the industry evolves.

Summary:

ROOT is a digitally-native, AI-driven insurer that puts technology at the heart of auto insurance. Its ability to personalize pricing at scale, deepen its partnership network, and grow profitably sets ROOT up for a possible insurtech comeback story—so long as execution sustains the recent momentum and competitive advantages solidify.

Financial Snapshot (Q1 2025 / TTM)

- Market Cap: ~$200M (as of July 2025)

- Q1 2025 Revenue: $349.4M (beat consensus; +24% premium growth YoY)

- Net Income: $18M (EPS: $1.07; major swing to profitability in Q1)

- Operating Income: $24M; Adjusted EBITDA: $32M (shows narrowing losses and sustained operational turnaround)

- Loss Ratio: 58% (down 6 points YoY)—reflecting vastly improved risk controls and tech efficiency

- Combined Ratio: 96% (declined 6 pts YoY)

- Cash & Runway: Current ratio at 2.38, with liquidity sufficient to fund expansion and de-risk bankruptcy scenarios

- Valuation: Trades at a ~71x P/E (post-profit quarter), Price/Book around 1.6x—premium to some legacy players but justified by tech/IP value

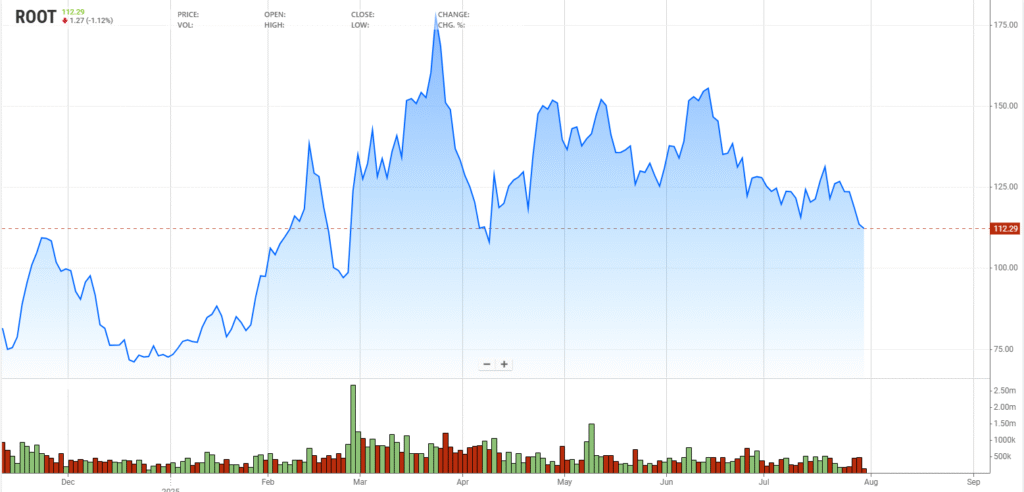

- Stock Performance: +122% YoY; Q1 rally cemented by earnings outperformance, although shares remain volatile (beta ~2.4)

Quick Peer Snapshot (as of July 2025)

| Metric | ROOT | Lemonade (LMND) | Progressive (PGR) |

|---|---|---|---|

| Market Cap | ~$200M | ~$620M | ~$95B |

| Loss Ratio | 58% | 72% | 65% |

| Adj. EBITDA | $32M (Q1) | ($25M) | $2.8B |

| 1-Yr Perf | +122% | +27% | +19% |

Investment Thesis

Bull Case Drivers

- Clear Path to Profitability: With better loss ratios and reduced cash burn, ROOT is halfway through a critical turnaround.

- Unique Price/Tech Model: Behavioral underwriting appeals to Gen Z/millennials and can break out from conventional price wars.

- Strategic Partner Potential: Partnerships with OEMs/dealers/rental agencies offer distribution at scale—and could make ROOT a prime acquisition target for big tech or auto players.

- Tech/IP Value: ROOT’s machine learning models and data assets are undervalued in the current stock price.

- Fresh Catalysts: Beat-and-raise earnings (next up Aug. 6, 2025), green-lighted expansion into new states/verticals, and positive sentiment towards small-cap tech rebounders.

Key Risks / Bear Case

- Fierce Competition: Auto insurance is extremely competitive, heavily regulated, and can squeeze margins, especially vs. deep-pocketed legacy players (GEICO, Progressive) and fintech rivals (Lemonade).

- Cash Burn Still a Concern: While Q1 saw a profit, volatility could return with weather/claims spikes or slower revenue growth.

- High Valuation: Elevated multiples could lead to sharp corrections on any misstep.

- Exposure to Macro/Claims Cycles: Unusually costly claim periods (like severe weather) or macroeconomic stress could harm near-term performance and raise capital needs.

Conclusion

Root, Inc. (ROOT) is quietly emerging as one of 2025’s most intriguing turnaround stories in fintech and insurtech. The company’s disciplined pivot—focusing on real-world driver data, tech-driven underwriting, and strategic partnerships—has translated into improved loss ratios, renewed profitability, and widening investor interest. While legacy challenges, competitive pressures, and valuation uncertainty remain, ROOT’s ability to grow profitably and carve out a unique, tech-forward market niche is gaining credibility with each quarter.

For investors, ROOT offers a classic “asymmetric bet”: high-risk due to execution demands and sector volatility, but with material upside if the company sustains momentum and leverages its technology in a highly regulated, slow-to-change industry. With Q2 results and possible new partnerships on deck, the coming months could be pivotal for both the stock and the company’s path to long-term relevance.

Bottom line:

ROOT is no longer just a hopeful insurtech story—it’s executing a tangible turnaround, harnessing data and digital distribution to rewrite the rules of auto insurance. For those willing to embrace volatility and believe in the endurance of tech-driven business models, ROOT stands out as a speculative but compelling “watchlist” candidate—and, perhaps, one of 2025’s