Introduction: Why Talk About Rapid7 Today?

In an environment marked by a surge in cyberattacks—from increasingly sophisticated ransomware campaigns to emerging threats in cloud infrastructure and IoT networks—the cybersecurity landscape is undergoing rapid evolution. Organizations face intensifying pressure to secure their digital assets as attack surfaces grow more complex and persistent.

This risk environment is now compounded by tightening regulatory frameworks across major global jurisdictions. In the U.S., the SEC is enforcing stricter cybersecurity disclosure rules. In addition, in the EU, the rollout of NIS2 and the upcoming DORA directive for financial services are establishing new standards of preparedness, monitoring, and incident response. Consequently, these developments are driving demand for comprehensive threat detection and response platforms such as XDR (Extended Detection and Response) and SIEM (Security Information and Event Management) solutions.

Against this backdrop, Rapid7 remains a key player in the industry. Its cloud-native security operations platform and growing focus on AI-automated detection and remediation workflows position it as a trusted partner for mid-sized enterprises seeking agile, end-to-end cybersecurity. However, despite these tailwinds, Rapid7’s stock has seen a significant correction over recent quarters—raising an important question:

📌 Is the market undervaluing a strategic cybersecurity asset in a sector poised for long-term, structural growth?

The Market: A Sector Fueled by Digital Threats

To understand Rapid7’s potential, we first need to look at the massive and growing market it operates in. The global cybersecurity market is currently booming, and it is expected to continue growing at a strong rate of 10-12% per year, reaching over $300 billion by 2027.

This rapid growth is fueled by several powerful trends:

- The move to the cloud and remote work has created more digital “doors and windows” for attackers to target.

- The explosion of connected devices (the Internet of Things or IoT) has multiplied the number of potential entry points for cyberattacks.

- Cyberattacks are becoming more frequent and sophisticated, especially with the use of AI-powered threats and ransomware.

- Finally, new government regulations (like NIS2 and DORA in Europe) are forcing companies to take cybersecurity much more seriously.

Where Rapid7 Fits in the Cybersecurity Market

The cybersecurity market is divided into several key areas. Rapid7 is strategically positioned at the intersection of three of the most important and fastest-growing segments:

- SIEM/XDR (Threat Detection and Response): This is the core of modern security operations, and Rapid7’s InsightIDR is a leading product in this category.

- Vulnerability Management: This involves finding and fixing security weaknesses before they can be exploited. Rapid7 has a long history of leadership here with its InsightVM and Nexpose products.

- MDR (Managed Detection and Response): This is where Rapid7 provides its expertise as a service, managing security 24/7 for companies that don’t have a large in-house team.

Here is a simple overview of the main market segments:

| Segment | Primary Focus | Key Players | Rapid7’s Position |

| Endpoint Security | Protecting devices like laptops | CrowdStrike, SentinelOne | Integrates via XDR |

| SIEM / XDR | Detecting & responding to threats | Rapid7, Splunk, Microsoft | Core Business |

| Vulnerability Mgmt. | Finding security weaknesses | Rapid7, Qualys, Tenable | Core Business |

| MDR Services | Security managed by experts | Rapid7, Arctic Wolf | Core Business |

Exporter vers Sheets

A Unique Position in a Crowded Field

While the market has many large players like CrowdStrike and Palo Alto Networks, Rapid7 competes by focusing on a specific customer: the mid-market and enterprises that are moving to the cloud.

Furthermore, its key advantage is its unified Insight Platform. Instead of selling many separate, complex tools, Rapid7 offers a single, integrated platform that is highly automated and easier for security teams to manage.

In conclusion, Rapid7 is not trying to be everything to everyone. Instead, it is solidly positioned in the highest-growth segments of the cybersecurity market—XDR, vulnerability management, and managed services—with a platform that is perfectly tailored to the needs of its target customers.

Of course. Based on this detailed information, I have created the next section of the newsletter.

This part focuses on how Rapid7 diversifies its business across different products and customer types to build a strong and resilient company.

A Diversified Approach to a Complex Market

Rapid7’s strategy is not just about focusing on one cybersecurity niche. Instead, the company has built a broad and flexible portfolio of products that can serve a wide range of customers and security needs. This diversification is a key part of its strength.

A Modular and Integrated Product Portfolio

The company organizes its technology into six key security areas, which can be thought of as “modules” on its Insight Platform:

- Incident Detection & Response (to find and stop active attacks)

- Cloud Security (to protect cloud-based applications and data)

- Vulnerability Management (to find and fix security weaknesses)

- Application Security (to secure the software a company builds)

- Threat Intelligence (to stay ahead of new and emerging threats)

- Security Automation (to make security operations faster and more efficient)

The key advantage here is flexibility. A smaller company might start by buying just one solution, like vulnerability management. Then, as its needs grow, it can easily add other modules like cloud security or threat detection. This “upsell” strategy is a powerful engine for growth and makes the platform very sticky for customers.

Serving a Wide Range of Customers and Industries

This modular approach allows Rapid7 to serve a very diverse customer base. For example, their products are used by:

- Small and mid-sized businesses that need powerful but easy-to-use tools.

- Large enterprises that require a comprehensive, unified security platform.

- Companies across all industries, from finance and healthcare to retail and manufacturing.

Furthermore, Rapid7 diversifies its revenue by offering both software (SaaS) and services. With its Managed Detection and Response (MDR) offerings, the company provides 24/7 expert monitoring for customers who don’t have a large internal security team. This combination of technology and human expertise is a major differentiator.

In conclusion, Rapid T’s diversification is one of its core strengths. By offering a broad, modular portfolio of products and services, the company can land customers with a single solution and then grow with them over time. This strategy allows it to capture recurring revenue from multiple fast-growing segments of the cybersecurity market.

Strategy & Positioning: The Security Engine for the Mid-Market

Now that we understand the market’s challenges, let’s look at how Rapid7 plans to win. The company’s strategy is not to compete head-to-head with the largest players on every front. Instead, it is focused on a clear, long-term vision: to automate threat detection and simplify security responses.

The Core Vision and Target Market

The main goal for Rapid7 is to make security operations easier and more effective for companies that are often overwhelmed by the frequency and complexity of cyberattacks.

To do this, the company has carved out a specific niche. Its core market is the “mid-market”—medium-sized businesses and larger enterprises that are in the process of moving their operations to the cloud. This is a smart focus because this segment is often under-served by the security giants and values solutions that are both powerful and easy to use.

The Unified Platform and Product Strategy

Rapid7 delivers its services through a single, unified cloud platform called the Insight Platform. This approach simplifies things for customers, who can manage all their security needs from one place.

The company’s product strategy is built on four key pillars:

- AI and Automation: They use practical AI to speed up the detection of threats and automate responses, saving security teams valuable time.

- Cloud-Native Solutions: Their tools are specifically designed for modern cloud and hybrid environments, making them easy to deploy and scale.

- Up-to-Date Threat Intelligence: The platform is constantly updated with the latest research on new and emerging cyber threats.

- Managed Services: Crucially, Rapid7 offers 24/7 monitoring and response services. This is a major differentiator for companies that don’t have their own large, in-house team of security experts.

The Competitive Landscape: Finding a Niche

So, how does Rapid7 compare to its competitors?

- Versus Giants (like CrowdStrike & Palo Alto Networks): While these giants often focus on locking in the world’s largest companies (the Fortune 100), Rapid7 positions itself as the agile security “engine” for companies in digital transition. It is known for its ease of use and broad cloud integrations.

- Versus Challengers (like SentinelOne): While SentinelOne is known for its advanced, automated endpoint protection, Rapid7 stands out with its unified platform approach and its strong focus on managed services, which appeals to customers seeking a partnership rather than just a complex set of tools.

In conclusion, Rapid7’s strategy is to be the go-to security operations backbone for the mid-market and cloud-focused enterprises. It aims to provide a powerful, comprehensive solution that is less complex and rigid than many of its larger competitors

How Rapid7 Makes Money: A Look at the Revenue Model

Now that we understand the company’s strategy, let’s look at how it actually makes money. Rapid7’s revenue model is a key strength and is exactly what investors like to see in a modern software company.

First and foremost, the business is built on recurring revenue. Over 75% of the company’s revenue comes from SaaS subscriptions and managed services. This is based on a metric called Annual Recurring Revenue (ARR).

So, what does this mean? It means that the vast majority of Rapid7’s income is predictable and stable, coming from customers who pay on a recurring basis (usually yearly) to use its platform and services. In fact, over 90% of the company’s total revenue is considered recurring. This provides a huge advantage, as it gives the company excellent visibility into its future performance.

As of the first quarter of 2025, Rapid7’s ARR stands at $837 million, and the company expects it to grow to between $850 and $880 million for the full year.

The Products Driving the Revenue

This strong recurring revenue is generated by the company’s flagship products on its Insight Platform:

- InsightIDR: For threat detection and response.

- InsightVM: For managing security vulnerabilities.

- InsightConnect: For automating security workflows.

Furthermore, the company’s growth strategy is very effective. It focuses on “upselling” by encouraging existing customers to adopt more of these integrated tools. For instance, a customer who starts with vulnerability management (InsightVM) can easily add threat detection (InsightIDR), which increases their spending and locks them more deeply into Rapid7’s platform. This is reflected in the high average ARR per customer, which has now reached $72,000.

In conclusion, Rapid7’s ARR-driven business model provides it with exceptional stability and financial visibility. This predictable, subscription-based income makes the company highly resilient, even in an uncertain economic environment where other companies might see their sales fluctuate.

What Makes Rapid7 Stand Out? (Its Competitive Advantages)

Rapid7’s competitive edge comes from making powerful cybersecurity simple and accessible. Its key advantages are:

- A Unified and Flexible Platform: Unlike competitors with separate tools, Rapid7’s Insight Platform centralizes vulnerability management, threat detection, and automation in one place, reducing complexity for security teams.

- Deep Expertise in Vulnerability Management: The company is a trusted pioneer in this field, built on its industry-leading Nexpose and InsightVM heritage, which creates strong customer credibility.

- A “Turnkey” Solution for Mid-Sized Teams: Its Managed Detection and Response (MDR) service provides 24/7 expert security monitoring, offering a complete solution for companies without a large in-house security team.

- A Focus on User Experience and Automation: Rapid7 is consistently praised for its easy-to-use interface and powerful automation, allowing even resource-limited teams to handle complex security tasks effectively.

The Investment Thesis: Opportunities vs. Risks

Now that we have a full picture of the company, let’s weigh the final arguments for and against investing in Rapid7. The company presents a classic “turnaround” story, with clear potential but also significant risks.

The Opportunities (The Bull Case)

First, the company is operating in a massive and growing market. The global cybersecurity market is expected to surpass $400 billion by 2030, with double-digit annual growth. This means there is a powerful tailwind that can lift all boats, and Rapid7 is perfectly positioned to benefit.

Second, its business model is very “sticky.” With its integrated platform and high percentage of Annual Recurring Revenue (ARR), it is difficult and costly for customers to switch to a competitor once they are using Rapid7’s ecosystem. This creates a strategic moat.

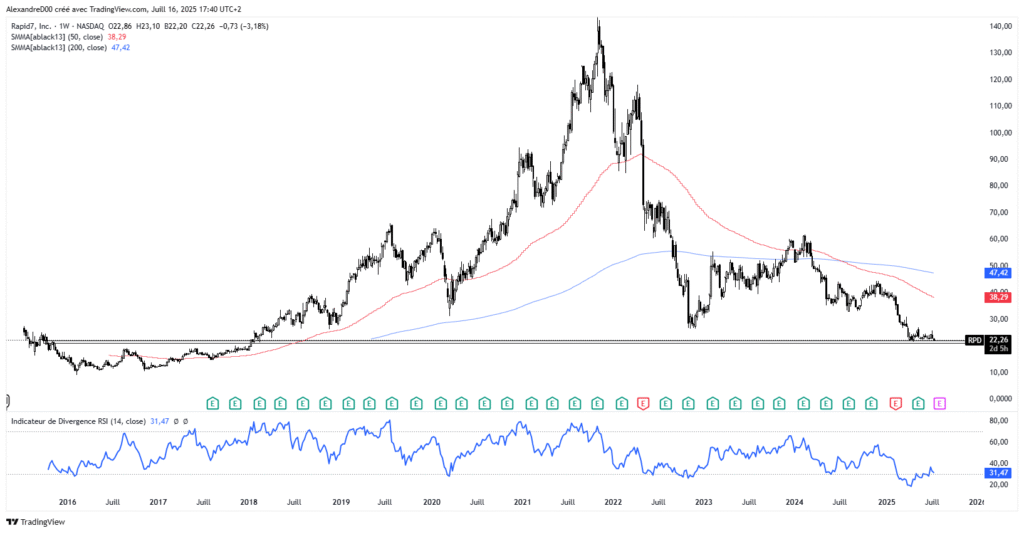

Furthermore, there is a technical argument for a potential reversal. The company’s stock is down over 60% from its 2021 peak. However, the chart is now showing signs that the bearish momentum is weakening. A strong support level has formed around the $40–$42 price range, and a breakout above $50 could signal the start of a new uptrend.

Finally, Rapid7 could be an acquisition target. It is currently valued at a much lower EV/Sales multiple (~3-4x) than its high-growth peers like CrowdStrike (~15x). This relative cheapness makes it an attractive target for a larger company or a private equity fund, which could provide a significant premium for current shareholders.

The Risks to Watch (The Bear Case)

However, it is crucial to understand why the stock is priced so cheaply.

The biggest risk is its persistent underperformance. Despite strong fundamentals, Rapid7’s stock has performed much worse than its cybersecurity peers and sector ETFs. This suggests that large, institutional investors have been rotating away from the stock, and a lack of strong conviction remains.

In addition, there is pressure on its profit margins. While revenue is growing, the company’s operating margins remain thin (around 4-6%), and it has not yet been able to generate consistent free cash flow. This is a major concern for investors who want to see profitable growth.

Lastly, there is a risk that this is a “value trap.” The stock looks “cheap,” but if the company cannot improve its margins or if its growth continues to decelerate, the low valuation may simply be a reflection of a structural slowdown, not an opportunity. The intense competition from giants like Microsoft and Palo Alto Networks, who are bundling security features, adds to this pressure.

Conclusion: Should You Invest in Rapid7 Today?

After a detailed analysis of the market, Rapid7’s strategy, its financials, and the associated risks, we can now answer the final question.

To conclude, Rapid7 presents the profile of a solid and very well-positioned player, with cutting-edge technology and a clear strategy focused on the mid-market segment. But on the other hand, the company operates in an extremely competitive and crowded cybersecurity sector, where pressure from giants like Microsoft or Palo Alto Networks is constant.

Therefore, the opportunity for investors rests on a major “if.” If Rapid7’s management succeeds in sustainably improving its profit margins and re-accelerating sales growth, then its current valuation, which is lower than its peers, offers the potential for a strong re-rating of the stock. The market is simply waiting for proof that the company can combine growth and profitability more effectively.

Final Recommendation

Ultimately, what should be done with Rapid7 stock? It is probably not a stock for investors seeking rapid, explosive performance.

However, for long-term oriented portfolios, Rapid7 represents a prudent, high-quality bet on the “mid-cap” (medium-sized company) cybersecurity segment. It is a way to invest in an unavoidable, long-term trend—the growing need for cybersecurity—via a company whose valuation has not yet reached the heights of its most prominent competitors.

For patient investors, the risk/reward profile is attractive.