Company: ONE EXPERIENCE

Industry: Real Estate & Technology

Ticker: ALEXP (Euronext Growth Paris)

Sub-Industry: Hospitality, Co-Living, Blockchain Tokenization

Introduction: Finding Stability in an Uncertain Market

This ONE EXPERIENCE stock analysis comes at a very important time. Currently, global markets are facing a new wave of uncertainty because of major trade tariffs. This creates a lot of volatility and pushes investors to look for safety. However, even during these challenges, certain industries and companies are not just surviving; they are built to succeed. Therefore, this report provides a deep dive into why the real estate sector is so strong right now. In addition, we will see how a unique company, ONE EXPERIENCE, is using new technology to build a business model for the future.

When Trade Wars Rise, Real Assets Rule

The main story shaking markets today is the news that new import taxes, or “tariffs,” will officially start on August 1st. These are not small changes; in fact, they are major taxes that will affect an estimated $2.3 trillion worth of goods.

This new policy creates several big effects on the economy. First of all, it can disrupt supply chains and increase the cost of everyday products, which often leads to inflation. Secondly, it can hurt the profits of many large companies, making the stock market seem like a risky place to be.

As a result, many investors start to feel nervous. When the future of company profits is hard to predict, people often sell their stocks. This leads to a “flight to safety,” where investors move their money into assets that are more stable and predictable. This is precisely where the real estate sector becomes very interesting.

Real Estate: The Original Safe Haven Asset

Real estate has long been considered a foundational pillar in any diversified portfolio. Why? Because it’s rooted in scarcity and In this uncertain climate, the real estate market has become a standout performer. This is not a coincidence, but is due to the safe and defensive nature of owning property.

To begin with, high-quality real estate provides very predictable income. Unlike other businesses, property owners have long-term contracts, called leases, with the people or companies that rent from them. This means they can count on a steady stream of rental income every month, which is very valuable when other industries are struggling.

Furthermore, physical property has always been a great way to protect against inflation. When the cost of living goes up, the value of buildings and the rent that can be charged also tend to rise. This helps investors protect their money.

Finally, certain types of real estate are booming right now. For instance, the demand for flexible living and travel has come back strong. This directly boosts the hospitality and co-living sectors where ONE EXPERIENCE has smartly focused its business.

Company in Focus: ONE EXPERIENCE (ALEXP)

Within this strong real estate sector, ONE EXPERIENCE stands out. It smartly combines the stability of physical property with the exciting potential of digital technology. This is a publicly-traded French company that specializes in high-demand properties like hotels, co-living buildings, and flexible offices. However, what truly makes the company so different is its forward-thinking use of blockchain technology.

A Snapshot of the Company’s Financials

To get a clear picture of ONE EXPERIENCE, we first need to look at its numbers. Because it is a young company building a new type of business, its financials show it is investing heavily in future growth.

Here’s a deeper look at the numbers (in millions of euros):

| Metrics | Implcation | Value |

| Stock price | €1.48 | |

| Revenue | A modest but real and growing revenue base. | €4.237M |

| Entreprise Value | Reflecting a lean market cap relative to operations. | €4.748M |

| EV/Revenue | A low ratio for a tech-enhanced real estate firm. | 1.12x |

| EBITDA | Current losses are expected in early growth phases. | -€0.562M |

| EV/EBITDA | Negative due to unprofitability but suggests leverage for upside. | -8.45x |

| P/E Ration (PER | Negative, in line with pre-profit status. | -2.21 |

What does this mean for investors? ONE EXPERIENCE is not priced like a mature REIT or a blue-chip tech firm. Instead, it’s trading more like a call option on the future of real estate tokenization. If and when the company reaches profitability, its low EV/Revenue could make it a candidate for major re-rating.

The Technology Driving the Business

The company’s entire model is built on a process called tokenization. To put it simply, they take a real estate property and represent it as digital “tokens” on a secure system called a blockchain.

This has two huge benefits. First, it makes real estate investing accessible to everyone. Instead of needing millions of dollars to buy a building, investors can now buy just a few tokens, which are like small digital shares of the property. Second, it makes the investment “liquid,” meaning the tokens can be traded more easily and quickly than a physical building.

This innovative model is already working. For example, the company successfully tokenized a property in Lille, France, which is now delivering a 6% annual return to its investors.

Tokenization: The Next Trillion-Euro Trend?

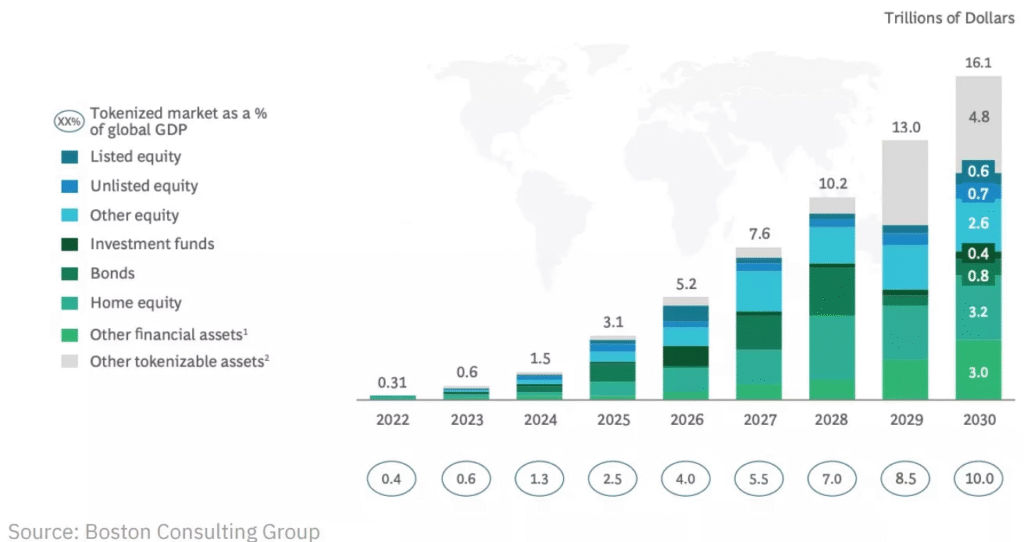

The concept of tokenizing real-world assets (RWAs) isn’t just buzz—it’s backed by serious forecasts. Boston Consulting Group projects that up to $16 trillion in assets could be tokenized by 2030.

That includes:

- Real estate

- Art and collectibles

- Private equity

- Infrastructure assets

Tokenization promises to revolutionize how people invest by:

- Breaking down barriers: You don’t need €500,000 to buy into a hotel—just a few euros for a token.

- Improving liquidity: Secondary markets allow faster exits and better price discovery.

- Increasing transparency: Blockchain provides immutable proof of ownership and transaction history.

ONE EXPERIENCE is positioning itself as one of the first movers in this field. Its token model has been proven in the field, and its public listing gives it credibility and access to capital that startups often lack.

The Bull Case (Why to Invest):

- First and foremost, the company operates in the resilient real estate sector

- The company’s business model is both proven and innovative, blending property with with high-growth blockchain technology.

- It is a pioneer in a multi-trillion dollar growth market (tokenization).

- Its stock appears cheaply valued on a sales basis (EV/Sales of 1.12x).

The Risks to Watch:

- The company is not yet profitable, making it a riskier investment.

- As a small-cap stock, it is likely to be more volatile.

- Its success depends on the broad market adoption of tokenization, which is still a new concept.

Conclusion: Is ONE EXPERIENCE a Good Investment?

Now, let’s summarize the final investment case.

On one hand, the reasons to invest are strong:

- The company operates in the stable real estate sector.

- It uses an innovative and proven business model that combines property with blockchain.

- It is a pioneer in the multi-trillion dollar tokenization market.

On the other hand, investors should know the risks:

- The company is not yet profitable.

- As a small company, its stock price is likely to be more volatile.

- Its success depends on tokenization becoming more popular in the future.

Final Recommendation: Speculative Buy

Therefore, after weighing the huge potential against the clear risks, our analysis ends on a positive note. ONE EXPERIENCE offers a rare chance to invest in the future of real estate. For this reason, it is best suited for long-term investors with a higher tolerance for risk. For that type of investor, ONE EXPERIENCE (ALEXP) is a Speculative Buy.