Why Esker Matters Now: A New Digital Era in France

As France stands on the brink of a major regulatory shift, a new digital era is about to unfold: starting September 1st, 2026, electronic invoicing will become mandatory for all large companies, followed by small and medium businesses in 2027. This reform, mandated by the national finance law and led by the French tax authorities, will require all VAT-registered companies to issue and receive invoices exclusively in electronic form, using government-certified platforms. The goal? To accelerate France’s digital transformation, strengthen the fight against tax fraud, and profoundly modernize how business documentation is handled.

This transformation aligns with a broader trend: the rapid digitization of back-office functions in the post-COVID era. Automation, paperless processes, and operational efficiency have shifted from optional improvements to core strategic imperatives.

Amid this backdrop of regulatory urgency and digital acceleration, one French company deserves closer attention: Esker. Still relatively under the radar, Esker is in fact one of the global leaders in document process automation—a quiet champion with solid financials and a proven technological edge. As the wave of mandatory e-invoicing approaches, one has to wonder: Is Esker the hidden machine of the CAC Mid 60, poised to surf a rising tide the market hasn’t fully priced in yet?

The Market: A Wave of Mandatory Digitalization

To understand why a company like Esker is so interesting right now, we first need to look at the powerful forces reshaping its market. There is a “perfect storm” of factors that are forcing businesses to digitalize their operations, creating a huge opportunity for software providers.

1. The Biggest Driver: A New Law in France

The most important force is not a trend; it’s a law. The French government has made electronic invoicing mandatory for all businesses.

- Starting September 1, 2026, all large and mid-sized companies in France must be able to issue electronic invoices. At the same time, all French companies, regardless of size, must be able to receive them.

- One year later, on September 1, 2027, all small and micro-businesses will also be required to issue e-invoices.

Essentially, this law forces the entire French business ecosystem to go digital at the same time. Companies must use state-certified platforms, known as “PDPs,” to ensure their invoices are compliant.

2. The Economic Necessity

In addition to this legal deadline, there are strong economic reasons pushing companies to act now. In the current environment of higher interest rates, managing cash flow is a top priority for every business.

Therefore, automation tools are more valuable than ever. They help companies:

- Get paid faster by automating the invoicing and collections process.

- Improve productivity by reducing manual, paper-based work.

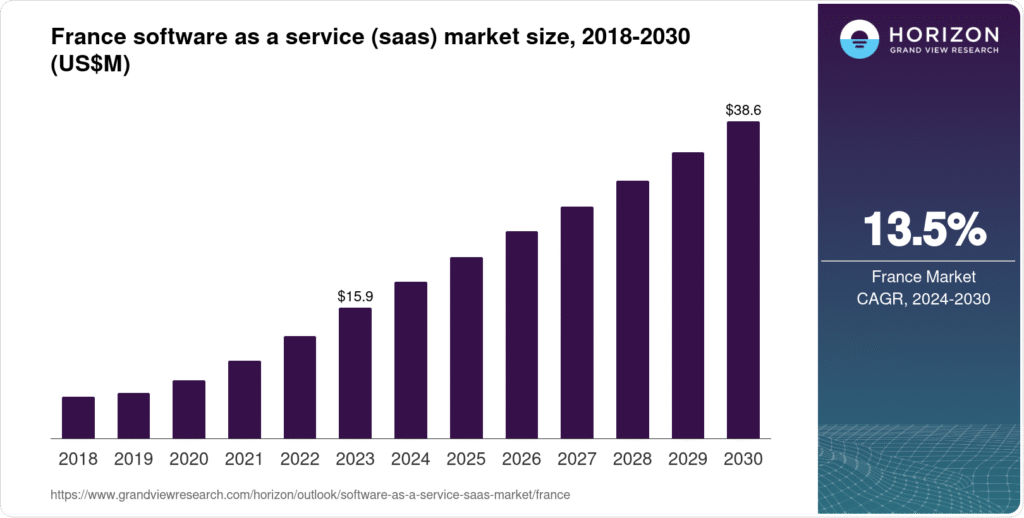

3. The Rush to the Cloud (SaaS)

As a result, this combination of legal and economic pressure is causing a massive shift toward cloud-based software, also known as SaaS (Software-as-a-Service). Companies are choosing SaaS solutions because they are flexible, easy to update, and can quickly ensure compliance with new laws. This trend is a major tailwind for SaaS providers like Esker.

The Competitive Landscape

This guaranteed market growth has attracted a lot of strong competitors. Esker is not alone and faces competition from both specialized and larger, more generalist software companies.

Here is a look at some of the main players in the European and international market:

| Company | Main Focus | Headquarters |

| Basware | Procure-to-Pay & Invoice Automation | Finland |

| DocuWare | Document Management & Digitization | Germany |

| Yooz | Invoice Automation for SMBs | France/USA |

| Sage | ERP & E-invoicing | UK |

| Sovos | Tax Compliance & E-invoicing | USA |

| Opentext | Digital Transformation, Document Management | Canada |

| Sap Ariba | Cloud Procure-to-Pay Platform | Germany |

In conclusion, the market for B2B automation is at a major turning point. The combination of regulatory deadlines and economic needs has created a strategic window of opportunity for the leaders in this space.

Focus on the Company: Esker’s Powerful Business Model

In the booming market of digitalization, Esker stands out as a global leader. So, what exactly does the company do, and what makes its business model so strong and attractive to investors?

Esker is a French software company that helps businesses around the world automate their financial processes. In simple terms, it provides a cloud-based platform that helps companies move away from slow, manual, paper-based work and become more efficient.

The Power of a Recurring SaaS Model

First and foremost, Esker’s main strength comes from its Software-as-a-Service (SaaS) business model.

- An incredible 82% of Esker’s revenue is recurring, coming from these SaaS subscriptions. This means the company has excellent visibility and predictability for its future income, which is a very attractive feature for investors.

- Furthermore, this core business is growing rapidly. While total company revenue grew by a strong 15% last year, the most important part—SaaS subscription revenue—grew by a massive +33%.

Mission-Critical Solutions with Global Reach

Another key point is that Esker’s software isn’t just a “nice-to-have” tool; it is deeply integrated into its clients’ most important back-office functions. Its platform automates critical cycles like “Order-to-Cash” (getting paid by customers) and “Purchase-to-Pay” (paying suppliers). Because of this, Esker’s solutions are essential for helping businesses manage their cash flow and improve productivity, which is highly valued in today’s economic environment. This also means customers are very loyal and unlikely to leave.

In addition to its strong model, Esker has successfully expanded across the globe, with dynamic growth in Europe, the US, and the Asia-Pacific regions.

Key Financial Highlights (2024)

The strength of this business model is clearly visible in the company’s financial results.

| Metric | Trend / Value |

| Total Revenue | €205.3 million (+15% year-over-year) |

| SaaS Revenue % | 82% of total company revenue |

| SaaS Subscription Growth | +33% year-over-year |

| New Bookings Growth | +22% (commitments for future revenue) |

| Net Cash Position | €70.2 million (strong balance sheet) |

| 2025 Profitability Target | 13-15% operating margin Exporter vers Sheets |

In conclusion, Esker’s business model combines the predictable, recurring revenue of a top-tier SaaS company with the resilience of a business that provides essential, high-value services. This powerful combination is why the company is considered a quiet champion in its field.

Financial Analysis & Valuation

Now that we understand Esker’s powerful business model, let’s look at the financial numbers. The data shows a high-quality, profitable, and financially sound company that commands a premium price in the stock market, and for good reason.

A Premium Price for a High-Quality Business

First, it is important to understand that Esker’s stock is not “cheap” in the traditional sense. Its valuation ratios are high, which shows that investors have a great deal of confidence in its future.

| Metric | Value |

| Market Cap | €1.65B |

| Stock Price | €277.40 |

| EV/EBITDA | 77–78x |

| P/E | 95–100x |

| EV/Sales | 8x |

| SaaS Revenue | 82% of total |

| YoY Revenue Growth | 13–15% |

| ROE | 15.3% |

| Net Debt | Negative (net cash position) |

| R&D Investment | Significant |

| Churn | Very low |

Here are the key valuation metrics:

- P/E Ratio: Around 95-100x

- EV/EBITDA Ratio: Around 77-78x

- EV/Sales Ratio: Around 8x

These numbers are much higher than those of older, slower-growing software companies. However, they are in line with other high-growth, global SaaS leaders. The market sees Esker as a “compounder”—a company that can grow steadily and reliably for a very long time.

This high valuation is supported by the company’s impressive growth profile.

- Sustained Growth: Esker consistently grows its revenue by 13-15% per year.

- High-Quality Revenue: 82% of this revenue is from recurring SaaS subscriptions.

- Future Visibility: New business bookings grew by +22% last year, which gives a strong indication of future revenue growth.

A Rock-Solid Financial Foundation

Furthermore, unlike many high-growth tech companies, Esker is very profitable and financially disciplined.

- Strong Profitability: The company has a Return on Equity (ROE) of over 15%, which is a sign of a very high-quality and efficient business. Its operating margin is also strong, at around 13%.

- No Debt: Esker has a net cash position, meaning it has more cash on hand than total debt. This is a very strong and safe financial position, which allows it to invest in R&D and future growth without risk.

- Excellent Liquidity: Its Current Ratio of 2.8 shows it has more than enough cash and short-term assets to cover all of its short-term bills.

In summary, Esker has the financial profile of a top-tier European SaaS company. It combines sustained, double-digit growth with strong profitability and a very safe balance sheet. While investors are paying a premium price for the stock, that premium is backed by high-quality, predictable recurring revenues and a clear path for future growth.

The Investment Thesis: Opportunities vs. Risks

Esker presents a very compelling story, but like any investment, it comes with both significant opportunities and clear risks. Understanding both sides is key to making an informed decision.

The Opportunities (The Bull Case)

First, the company benefits from a “captive market” created by new laws. The new mandates for electronic invoicing in France and across Europe are the most powerful tailwind for Esker. This is because they force hundreds of thousands of businesses to adopt a digital solution. This is no longer optional; it’s a legal requirement, which creates guaranteed, sustained demand for platforms like Esker’s.

Second, its SaaS business model is built to scale profitably. As a cloud-based software company, Esker has strong operating leverage. In other words, adding each new customer is very profitable because the main technology platform is already built. This allows the company to grow its high-margin, recurring revenue streams very efficiently as it expands.

Finally, Esker is recognized as a premium, high-quality leader. The company is consistently named a “Leader” or “Challenger” in the prestigious Gartner® Magic Quadrant™. This recognition confirms that its AI-driven technology is more advanced than many generic solutions. As a result, larger companies that need reliable, secure, and compliant automation are often willing to choose Esker over a more basic competitor.

The Risks to Watch (The Bear Case)

However, there are also important risks to consider.

The biggest challenge is the long sales cycle. Winning large corporate clients is a complex process. It can take a long time to finalize a deal and integrate Esker’s platform into a client’s existing systems. This means that revenue growth can sometimes be “lumpy” or slower than expected.

In addition, there is a risk of a mid-market slowdown. Esker’s core clients are often mid-sized businesses. If the economy slows down, these companies might postpone or reduce their spending on new technology projects, which would directly impact Esker’s growth.

Lastly, competition from software giants is always present. Large ERP providers like SAP and Oracle are increasingly adding their own automation features. Esker must continue to innovate and prove its superior value to compete with these giants who can sometimes bundle similar features for existing customers at a low cost.

Conclusion: What Role for Esker in a Portfolio?

After analyzing the market, Esker’s solid business model, its premium valuation, and the associated opportunities and risks, we can now answer the final question: what is the nature of an investment in Esker today?

To summarize, the story of Esker is one of healthy and visible growth.

- First, the company benefits from exceptional long-term visibility, primarily thanks to the wave of mandatory electronic invoicing that guarantees sustained demand for its solutions.

- Second, its technology is not just useful; it’s essential. By automating critical financial processes, Esker helps its clients improve productivity and manage their cash flow, which is crucial in the current economic environment.

- Finally, its SaaS model, with 82% recurring revenue and a healthy financial position (no net debt), makes it a very high-quality company.

So, is Esker a “defensive tech” investment or simply a fairly valued company?

The answer is a bit of both. Esker is not a “defensive” stock in the traditional sense, like a utility company. However, the non-negotiable nature of the demand (due to the law) and the critical importance of its solutions for its clients give it rare defensive qualities for a technology company.

Its premium valuation (with a P/E of 95-100x) reflects this quality and its strong growth prospects. Investors today are paying a high price, but they are paying for a superior-quality business with high visibility.

Final Recommendation

For long-term investors looking to gain exposure to the digitalization of the economy through a profitable, solid, and market-leading company, Esker represents an excellent choice. It is not a cheap stock, but rather an investment in visible, high-quality growth.