by Nikhil Kumar | Jun 24, 2025 | Investment Analysis

OPEC+ Extends Output Cuts Through 2025: Oil Jumps 4.2%, Energy Stocks Rally Oil Markets Surge After OPEC+ Decision In a significant move to stabilize global oil prices, OPEC+ announced it will extend its voluntary production cuts through the end of 2025. This decision...

by Nikhil Kumar | Jun 24, 2025 | Investment Analysis

India Raises Wheat Export Tax by 20%: U.S. & EU Food Stocks React as Prices Spike India’s Wheat Policy Shakes Global Agriculture Markets In a surprise policy shift, the Government of India has imposed a 20% export tax on wheat, effective immediately. This decision...

by Nikhil Kumar | Jun 23, 2025 | Investment Analysis

EU Auto Sales Down 6.8% in May: BMW, Stellantis Shares Slide as EV Competition Heats Up Europe’s Auto Sector Slams the Brakes European automakers are facing fresh turbulence as passenger car sales across the EU fell by 6.8% year-over-year in May 2025, according to the...

by Nikhil Kumar | Jun 23, 2025 | Investment Analysis

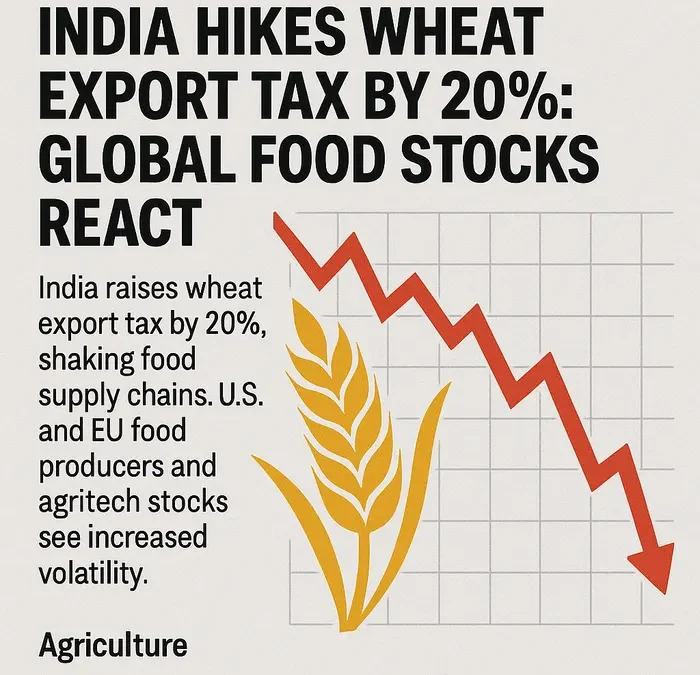

China’s Tech Crackdown Wipes $120 Billion: Nasdaq Futures Dip 1.4% Global markets are once again rattled by renewed regulatory actions from China, targeting its domestic technology giants. The Chinese government’s intensified crackdown has wiped over $120...

by Nikhil Kumar | Jun 23, 2025 | Investment Analysis

Strait of Hormuz Blockade: A New Flashpoint Threatening Global Energy SecuritY AND OIL & PETROLEUM Strait of Hormuz, global energy supply, Middle East tensions, Iran blockade, oil transport chokepoint, US-Israel conflict, Asian energy security A Strategic Strait...

by Vishesha Dungarwal | Jun 23, 2025 | Investment Analysis

Oil, War, and the Return of Energy Power Plays It’s mid-2025, and the world feels eerily familiar—yet undeniably altered. After years of optimism around renewable energy and decarbonization, the harsh realities of geopolitics have come crashing back into the...

by Vishesha Dungarwal | Jun 23, 2025 | Investment Analysis

Apple Inc. (NASDAQ: AAPL). You’ve heard of it. You probably own one of its products. Maybe a dozen. And if you’re reading this, you’re probably wondering: is owning the stock in 2025 still as smart as owning the iPhone in 2007? With a $3 trillion valuation...

by Rayane El Hannouti | May 27, 2025 | Investment Analysis

Gold in the Ground, or a Mirage in the Market? A full-spectrum financial and macroeconomic analysis of a speculative gold explorer Introduction: Gold Glitters Again—But Should You Bet on It? In an increasingly volatile global economy, investors are once again turning...