The Rise of CIFR in 2025

Cipher Mining (CIFR) has delivered one of the standout rallies in the crypto equity space year-to-date, driven by a compelling combination of rapid hashrate expansion, consistent improvement in bitcoin production, and aggressive strategic moves into high-performance computing (HPC). Today’s central question: Is the run-up in CIFR’s stock price built on genuine operational progress, or does it rest on speculative shifts within the crypto infrastructure stack? This report dissects the substance behind Cipher Mining’s YTD outperformance.

Key Drivers of the 2025 Rally

- Hashrate Expansion:

Cipher Mining has dramatically increased its operational hashrate, rolling out new facilities and upgrading existing sites. This ramp-up has made CIFR one of North America’s fastest-growing and most cost-efficient publicly traded bitcoin miners, further leveraging scale in the post-halving market. - Improving Bitcoin Production:

Monthly bitcoin output has markedly improved, with recent production consistently outpacing prior periods even as network difficulty rises. Lower energy costs and sophisticated mining firmware have contributed to this resilience. - Adoption of High-Performance Computing (HPC):

CIFR’s entry into the HPC market, including AI and data center services, marks a revenue diversification play and hedges against Bitcoin price volatility. Partnering with strategic providers, the company is monetizing excess energy and infrastructure—an increasingly popular move among major miners.

Is this rally justified by fundamentals or building on speculative shifts in crypto infrastructure?

Cipher Mining (CIFR): Business Model Overview

Core Business: Industrial-Scale Bitcoin Mining

Cipher Mining’s primary business is large-scale Bitcoin mining using company-owned and operated data centers. Key sites include:

- Odessa Facility: Flagship, state-of-the-art mining site in Texas.

- Black Pearl: Newly built site supporting major hashrate expansion.

Key Features:

- Full Ownership: Cipher controls its infrastructure, optimizing power usage, equipment layout, and operational flexibility.

- Industrial Scale: The company manages thousands of latest-generation ASIC mining rigs, scaling production to maximize bitcoin output based on network difficulty, bitcoin price, and energy market conditions.

- Efficiency: The rigs operate at an industry-leading average efficiency of ~18.9 joules/terahash (J/TH), limiting energy costs per bitcoin and increasing profitability over less efficient competitors.

Vertical Expansion: High-Performance Computing (HPC) Hosting

Cipher is leveraging its robust infrastructure and energy contracts to expand into High-Performance Computing (HPC) hosting, offering services to AI, machine learning, and advanced data workloads.

- Infrastructure Utilization: The same energy-hardened data centers used for mining are adaptable for HPC hosting, allowing Cipher to monetize excess capacity and diversify revenue streams.

- Market Opportunity: With demand for AI and HPC surging, especially in the U.S., this move provides a strategic hedge against Bitcoin market volatility and positions Cipher for future tech megatrends.

- Synergies: Expertise in managing high-density, energy-intensive operations translates well to supporting HPC clients.

Strategic Assets Supporting the Model

| Asset | Details |

|---|---|

| Low-Cost Power | Secured wholesale power at 2.7¢/kWh, among the lowest in the industry. Long-term contracts shield Cipher from price spikes and underpin cost leadership. |

| Efficient Mining Rigs | Rigs average ~18.9 J/TH efficiency, minimizing electricity consumed per bitcoin mined and improving margin sustainability. |

| Strategic Data Center Locations | Sites like Odessa and Black Pearl are located in energy-rich Texas, offering grid flexibility and access to renewable or “stranded” energy. |

| Strong Capital Pipeline | Ongoing investments, structured partnerships, and a healthy balance sheet ensure funding for expansion, tech upgrades, and opportunistic scaling. |

Summary

Cipher Mining’s business model is built on controlling world-class mining infrastructure, maintaining cost and efficiency leadership, and methodically diversifying into high-margin, future-proof verticals like HPC. The company’s combination of strategic power sourcing, site selection, efficient technology, and disciplined capital management provides resilience and upside as both Bitcoin and digital infrastructure evolve.

Operational Progress & Hashrate Growth

Cipher Mining (CIFR) has achieved substantial operational progress and hashrate growth in 2025, cementing its status as a top-performing, industrial-scale Bitcoin miner.

Hashrate Expansion

- Q1 2025: Cipher ended the first quarter with a self-mining hashrate of approximately 13.5 exahashes per second (EH/s), following the completion of major upgrades at its Odessa facility.

- Q2 2025 Update: The company outpaced earlier targets, reaching a total self-mining hashrate of about 16.8 EH/s by late Q2. This exceeded the guidance for Q2 due to accelerated ramping at the Black Pearl Data Center, where Phase I (150 MW) delivered 3.4 EH/s versus a forecast of 2.5 EH/s. This milestone was achieved ahead of schedule and with no additional capital expenditure.

- Projected Growth: Cipher maintains its expectation to further scale to approximately 23.1 EH/s by the end of Q3 2025, as new batches of mining rigs are deployed and legacy equipment is replaced. This aggressive hashrate growth trajectory positions Cipher as one of North America’s largest and fastest-growing miners

BTC Production & Inventory

- Production: In April, Cipher mined roughly 1,741 BTC. The latest June production was 160 BTC, reflecting some strategic power curtailment to optimize long-term costs during peak pricing periods.

- Inventory: At the end of June, Cipher’s BTC holdings stood at approximately 1,063 BTC, following routine treasury management sales of 58 BTC in the month.

Infrastructure Developments

- Black Pearl Data Center: Phase I (150 MW) was energized in May, bringing rigs online a quarter ahead of expectations, and immediately contributing to the hashrate boost. Additional capacity will be incrementally deployed through Q3 as more rigs come online.

- Strategic Execution: Cipher’s operational agility in redeploying and expanding mining hardware ahead of schedule has allowed it to surpass hashrate forecasts and demonstrate best-in-class execution. The company continues to advance plans for further capacity at both Black Pearl and other pipeline sites

Key Takeaways

- Operational discipline—such as sophisticated power management and phased rig deployments—has enabled Cipher to optimize both production and long-term profitability.

- Hashrate growth is driven both by new infrastructure and by maximizing utilization of inherited and incoming mining rigs.

- Cipher’s aggressive expansion, especially at Black Pearl, makes it a key player in U.S. bitcoin mining scale and efficiency.

Cipher Mining’s 2025 rally is thus grounded in robust, measurable operational achievements and infrastructure execution—supporting its valuation and sector leadership status.

Financial Snapshot – Cipher Mining (CIFR), 2025

Revenue:

- $49 million (Q2 2025, +16% quarter-over-quarter)

Cipher’s robust revenue growth reflects surging bitcoin production and capacity additions driven by new hashpower coming online at sites like Black Pearl.

Cash & Investing Activity:

- ~$23.2 million in cash on the balance sheet

- $82.1 million raised via ATM (At-the-Market offerings) and PIPE (private investment in public equity) transactions

This healthy war chest supports ongoing infrastructure expansion and provides runway for opportunistic scaling and balance sheet strength.

Capital Expenditure (CapEx):

- –$389 million (year-to-date)

Aggressive investments in new mining fleets and facility upgrades—notably the energizing of Black Pearl—drive forward-looking capacity and hash rate expansion.

Gross Margin:

- ~18%

Reflects industry-competitive cost structure, underpinned by ultra-low power agreements (~2.7¢/kWh) and efficient mining rigs (~18.9 J/TH). Margin resilience comes despite post-halving bitcoin reward pressures.

Operating Income:

- $146 million (TTM, trailing twelve months)

- $69 million (full-year 2024)

Operating leverage continues to improve, with rising revenues translating into meaningful cash generation as hash rate and bitcoin output grow.

Inventory / Bitcoin Holdings:

- ~1,063 BTC on balance sheet (end of June 2025)

A significant reserve reflecting treasury management strategy—both providing liquidity and potential upside from bitcoin price appreciation.

Key Takeaway:

Cipher Mining’s financials show not only rapid top-line growth and capex-driven expansion, but also disciplined liquidity management and strong operating momentum—hallmarks of a crypto miner scaling responsibly for both current profitability and future market leadership.

Strategic Pivot – From Mining to Computing

Cipher Mining (CIFR) is executing a major transformation in 2025, shifting from a pure-play bitcoin miner to an integrated digital infrastructure company with a focus on high-performance computing (HPC) and diversified data center services.

HPC Expansion: Barber Lake Joint Venture

- Barber Lake JV with Fortress Credit Advisors:

Cipher is developing Barber Lake as a flagship HPC site in partnership with Fortress Credit Advisors. This move enables the hosting and leasing of data center capacity for HPC workloads, such as AI and enterprise computing, alongside its traditional bitcoin mining activity. The hybrid structure allows Cipher to tap into higher-margin HPC services, making better use of its energy-secure, scalable infrastructure. The site is being developed with up to 500 MW potential for HPC, under exclusivity and active negotiations with major energy partners.

Multi-Gigawatt Pipeline

- 2.8 GW Expansion, 7 Site Portfolio:

The company is scaling beyond bitcoin by building a tapable 2.8 GW pipeline spanning seven strategic locations, including Black Pearl, Stingray, and Barber Lake.- Stingray (250 acres, 100MW in West Texas) is planned for energization in Q2 2026, designed for both cryptomining and potential HPC deployments.

- Black Pearl‘s next phase is also being considered for HPC use, demonstrating further vertical integration and flexibility.

- Barber Lake, with recently acquired adjacent acreage, provides runway for multi-phase data center expansion focused on high-value compute hosting.

Appeal to Investors

- Balanced Crypto & Infrastructure Exposure:

This dual-pronged strategy—industrial-scale bitcoin mining plus high-margin HPC data center leasing—broadens Cipher’s addressable market and revenue streams, while insulating against cyclical swings in bitcoin pricing. - Strategic Assets:

The company’s ultra-low energy costs (secured at 2.7¢/kWh), efficient mining fleet (~18.9 J/TH), and scalable capital pipeline support both hash rate expansion and new compute hosting ambitions. - Market Position:

By leveraging its operational track record in mining, Cipher aims to capture demand from AI, enterprise, and Web3 clients needing high-density compute capacity—a sector forecast for rapid, secular growth.

Summary:

Cipher Mining’s pivot into HPC, anchored by the Barber Lake joint venture and a growing 2.8 GW site portfolio, enables the company to monetize its infrastructure far beyond mining alone. This positions CIFR as a diversified “picks and shovels” play on both the future of Bitcoin and the booming, high-margin digital computing sector.

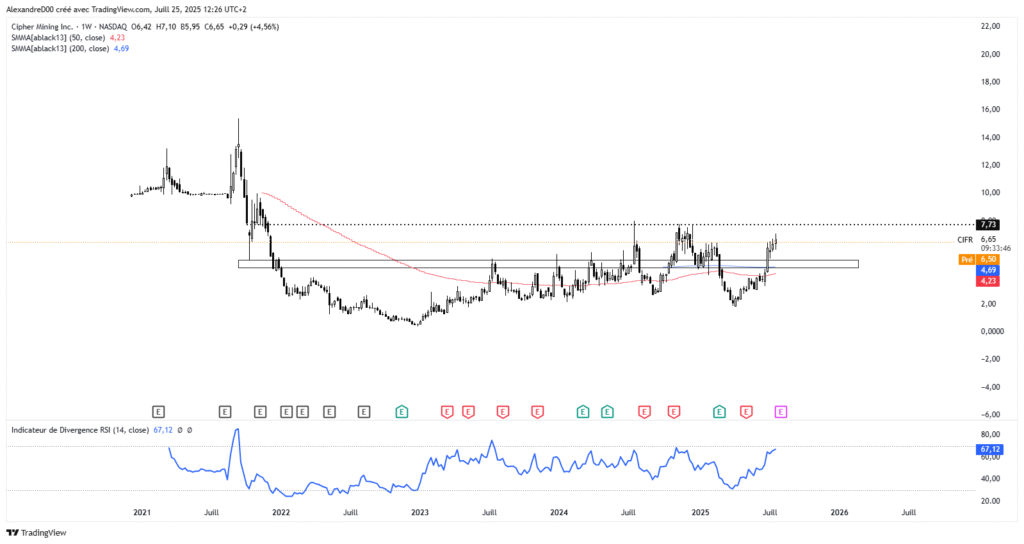

Stock Performance & Sentiment

Cipher Mining (CIFR) is currently trading around $6.64 per share as of late July 2025, with a market capitalization close to $2.4 billion. This price is significantly above the $5 level as a better entry, indicating the stock is perceived by many as somewhat elevated or possibly overvalued relative to fundamentals.

Supporting this view, short interest remains elevated according to discussions on Reddit, reflecting skepticism amongst some investors about Cipher’s execution or profitability prospects. However, the stock has shown strong institutional buying interest with major investors like Vanguard and Renaissance Technologies boosting their positions significantly in recent quarters. This institutional accumulation suggests growing confidence in the company’s long-term potential despite some market doubts.

Overall, the price strength appears to be supported by a mix of:

- Rapid hashrate expansion and bitcoin production gains.

- Strategic diversification into high-performance computing infrastructure.

- Institutional commitment raising the valuation floor.

Yet, the elevated short interest and valuation multiples caution that some investors expect challenges ahead or view the current price as pricing in optimistic execution and market conditions. A pullback to around $5 could align more with conservative fundamental valuations, but the upward momentum and institutional interest do keep the stock well supported at current levels.

Conclusion & Investment Thesis — Cipher Mining (CIFR) 2025 Outlook

Bull Case

Cipher Mining’s rally in 2025 is supported by multiple fundamental growth pillars:

- Strong Bitcoin Production: Growing monthly Bitcoin output, now exceeding 1,600 BTC per month, driven by rapid hashrate expansion and operational efficiencies.

- Accelerating Hashrate: Self-mining hashrate scaling aggressively, with ~16.8 EH/s in Q2 and a target of 23.1 EH/s by Q3, positioning CIFR as a leading North American miner.

- Cost Advantage: Secured ultra-low power contracts (~2.7¢/kWh) and highly efficient mining rigs (~18.9 J/TH) allow favorable margins despite the post-halving environment.

- Strategic HPC Diversification: Expansion into high-performance computing (HPC) hosting and leasing via joint ventures taps a high-margin growth market that diversifies revenue away from pure Bitcoin mining.

This multi-dimensional growth and infrastructure strategy provide CIFR significant operational leverage and market differentiation with potential for substantial medium-to-long-term upside.

Bear Case

However, risks temper enthusiasm:

- Persistent Losses: Despite revenue growth, recent quarters have seen losses or sharply declining profitability, highlighting margin pressure and cost management challenges.

- BTC Price & Macro Energy Risks: The company remains exposed to Bitcoin price volatility and potential energy market shocks. A BTC price downturn or rising energy costs could compress margins significantly and weigh heavily on stock performance.

- Speculative Components: HPC business and stock valuation partly reflect speculative expectations, as HPC revenue streams are early-stage and not yet proven at scale.

Verdict

Cipher Mining represents a growth-plus infrastructure play with a mix of solid operational fundamentals and speculative upside derived from its strategic pivot to HPC services. It is best suited for investors with a tolerance for capital-intensive, crypto-exposed businesses who can weather short-term earnings volatility in exchange for longer-term sector leadership potential.