Introduction: The Return of the Crypto King?

To understand the current excitement in the financial markets, one must turn to the king of crypto-assets: Bitcoin. While its history is made up of spectacular cycles, the one we are experiencing in 2025 feels different and deserves a deeper analysis.

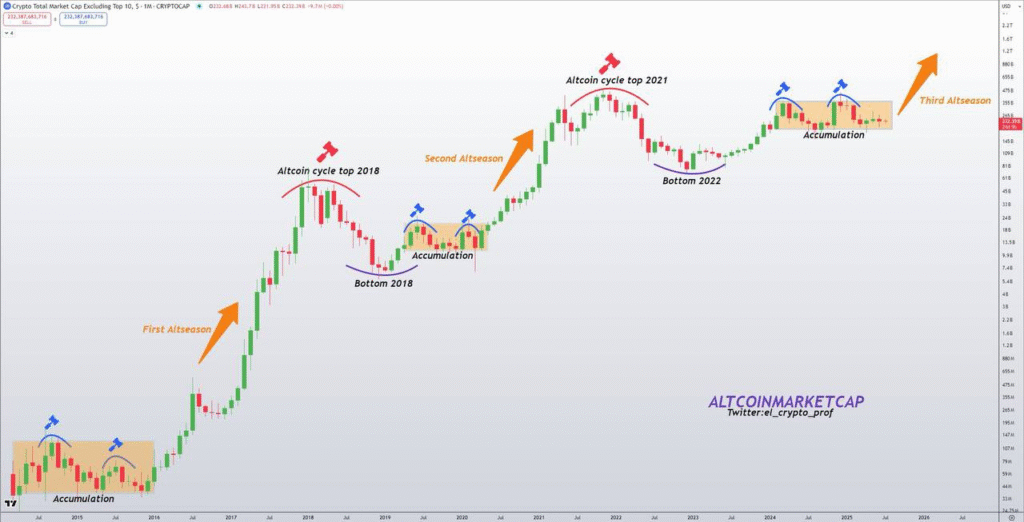

To put things in context, let’s recall the previous cycles. Historically, after each “halving” (the programmed reduction in the creation of new bitcoins, the last of which occurred in April 2024), the price of Bitcoin has entered a major upward phase, reaching a new peak approximately 12 to 18 months later. This is a pattern that repeated in 2013, 2017, and 2021.

This week, on Tuesday, July 8, 2025, history seems to be repeating itself, but with a new magnitude. Bitcoin has indeed established a new All-Time High (ATH), breaking the symbolic barrier of $112,000 to reach precisely $112,055. This new record Bitcoin price confirms the bullish momentum of Bitcoin 2025.

Therefore, a crucial question arises for all investors: are we witnessing a simple technical rally in line with past cycles, or are we on the verge of a new paradigm for Bitcoin, driven by more structural and sustainable forces?

To answer this question, it is essential to go beyond the simple price observation and analyze the deep-seated causes of this new wave of enthusiasm.

The Macro Context – Why Now?

This new all-time high for Bitcoin is no accident. It is, in fact, the result of a powerful convergence of several economic and structural factors that are creating a perfect environment for its growth.

First of all, monetary policy is playing a key role. Financial markets are anticipating future interest rate cuts from major central banks, like the US Federal Reserve. Such a decision tends to weaken the dollar. Consequently, investors look for alternatives to protect the value of their capital, which stimulates demand for scarce assets like Bitcoin.

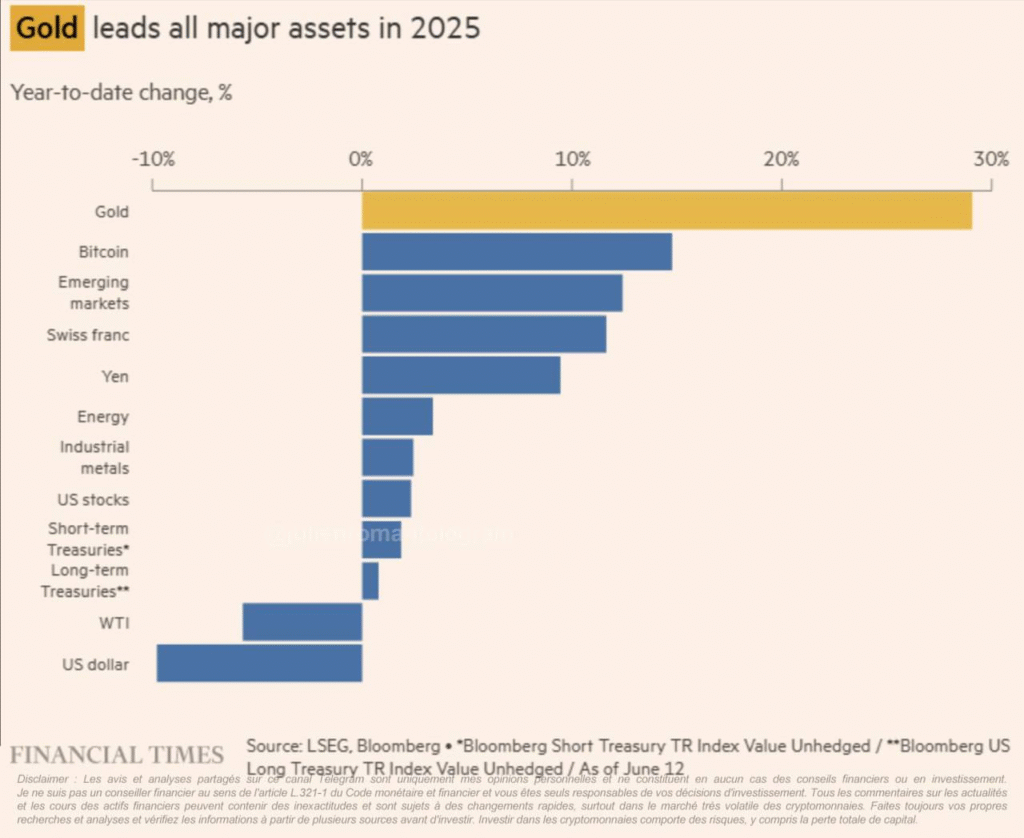

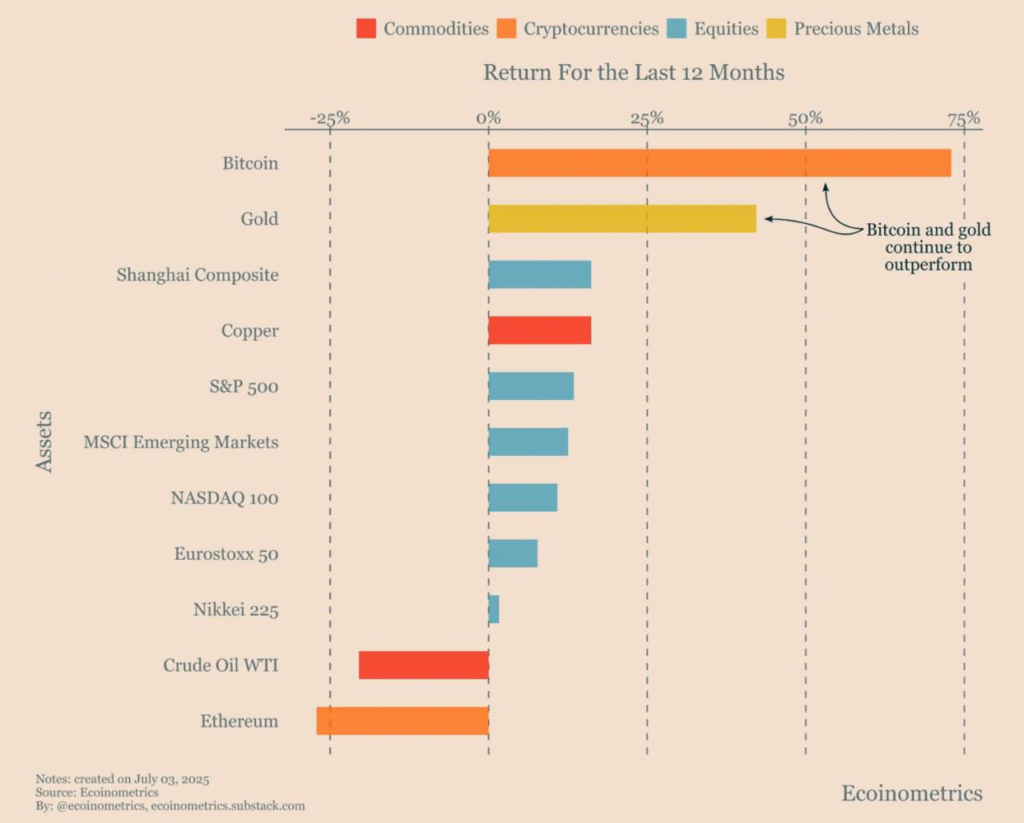

Next, current geopolitical tensions are increasing its appeal. In an uncertain world, investors traditionally turn to safe-haven assets. Gold has always been the historical standard, but Bitcoin is increasingly establishing itself as its digital alternative. The bitcoin vs inflation debate is more relevant than ever, with many seeing it as a hedge against economic instability.

Furthermore, a technical factor unique to Bitcoin is essential: the “halving bitcoin 2024”. This event, which took place in April 2024, cut the creation of new bitcoins in half. In other words, the supply of new BTC is now lower, which emphasizes its scarcity. When supply decreases while demand is rising, the price naturally tends to go up.

Finally, the most visible driver of this rally is the inflow of new money via “institutional bitcoin ETFs”. Since their approval, finance giants like BlackRock and Fidelity have enabled billions of dollars of institutional investment to enter the market. This has not only dramatically increased demand but has also strengthened Bitcoin’s legitimacy as a true financial asset.

In summary, the current situation is a “perfect storm” for Bitcoin. The combination of a looser monetary policy, an uncertain world, a reduced supply, and a massive inflow of institutional capital explains why the king of crypto is reaching new heights today.

Market Analysis: What Is the Data Really Telling Us?

To go beyond the news of the new all-time high, it’s crucial to analyze the different market data points. By combining technical analysis, on-chain metrics (from the blockchain), and general sentiment, we can get a complete picture of Bitcoin’s current momentum.

1. Technical Analysis: Consolidation After the Record

From a charting perspective, the situation is quite clear.

- Key Levels: After hitting a new high of $112,000, Bitcoin has found new support zones. The important levels to watch now are around $109,000 and $104,500.

- Indicators: The market speed indicator (RSI) approached the “overbought” zone during the climb, which signals a risk of a short-term correction. However, trading volumes, while strong when the record was broken, have since calmed down. This is typical and rather healthy behavior after such a rapid rise.

2. On-Chain Metrics: The Confidence of Long-Term Investors

Technical analysis doesn’t tell the whole story. Indeed, data coming directly from the blockchain gives us a deeper view of investor behavior.

- “Hodlers” Remain Strong: The data shows that long-term investors (nicknamed “hodlers”) continue to hold their bitcoin and are not selling en masse, which limits downward pressure.

- Transactions Are Profitable: Indicators like SOPR show that the majority of bitcoins being exchanged right now are sold at a profit. This is a sign of a healthy bull market.

- Potential for Further Upside: Other metrics, like the MVRV ratio, indicate that while the market is at a high level, it has not yet reached the extreme euphoria zones seen at previous cycle tops. In other words, there is still potentially room to go up.

3. Market Sentiment: Between Neutrality and Institutional Confidence

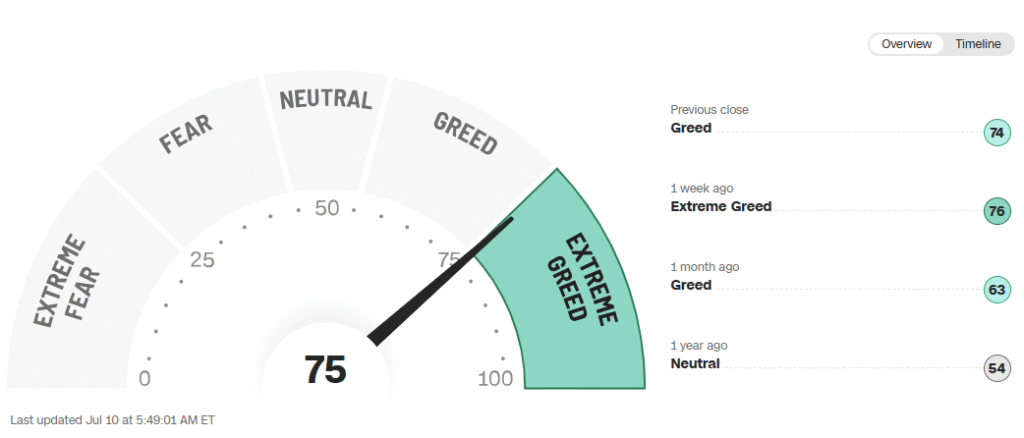

The general market sentiment has evolved. The “Fear & Greed” Index, which was at “extreme greed” when the ATH was broken, has now come back down and is fluctuating between 50 (Neutral) and 63 (Greed). This means that the initial euphoria has passed, and the market has entered a phase of “digesting” the new price.

Yet, this more neutral sentiment among retail investors contrasts with the continued confidence of major players. The data shows that “whales” (wallets holding more than 1,000 BTC) continue to accumulate bitcoin. Furthermore, volumes on Bitcoin ETFs remain massive, confirming that institutional demand is still very much present.

4. The Battle: Bitcoin vs. Altcoins

Currently, one of the most important dynamics in the market is Bitcoin’s strong dominance.

- The Key Number: Bitcoin’s dominance has reached 65%, a level not seen since early 2021. This means that Bitcoin represents 65% of the total value of the cryptocurrency market.

- The Consequence: When Bitcoin’s dominance is this high, money is concentrated on it, and other cryptocurrencies (altcoins) tend to underperform. The “Altcoin Season Index” is also very low, at around 27, which confirms that this is not yet the season for altcoins.

Historically, a high Bitcoin dominance is often followed, later in the cycle, by a rotation of capital into altcoins. But for now, King Bitcoin is overwhelmingly dominating the game.

Investment Opportunities

Now that we have a clear picture of the market, the question is: how should an investor position themselves? Bitcoin’s new All-Time High reshapes the strategies and opens up new opportunities across the entire crypto ecosystem.

For Retail Investors: Discipline and Rebalancing

For individual investors, the new record high is a double-edged sword.

On the one hand, it’s crucial to manage the feeling of “FOMO” (Fear Of Missing Out). You should avoid impulsive buys at the peak. Therefore, for those looking to start investing in crypto in 2025, a gradual approach like DCA (Dollar Cost Averaging), which involves investing a fixed amount at regular intervals, remains the most prudent strategy.

On the other hand, with Bitcoin’s dominance exceeding 62% of the market, portfolio management becomes essential. Indeed, now is the ideal time to think about your Bitcoin portfolio allocation. Investors who have benefited from the rally might consider taking some profits to rebalance their portfolio and avoid being overexposed to a single asset, no matter how well it’s performing.

For Professional Investors: Strategic Diversification

On the institutional side, the trend is clear. Bitcoin is increasingly being integrated as a strategic asset, now representing nearly 30% of institutional crypto portfolios.

However, this adoption does not come at the expense of diversification. On the contrary, it illustrates a professional crypto investor strategy that involves using Bitcoin as a solid foundation and then diversifying into other high-potential assets within the ecosystem.

Opportunities Across the Entire Crypto Ecosystem

Bitcoin’s success doesn’t just benefit itself; it paves the way for other opportunities.

- Major Altcoins: Although Bitcoin’s dominance is strong, projects like Ethereum (ETH), which already represents a quarter of the market, as well as Cardano (ADA) and Solana (SOL), are attracting institutional capital. Historically, a strong Bitcoin performance often precedes an “altcoin season.”

- Blockchain Infrastructure: Innovation continues at a frantic pace. Sectors like DeFi (Decentralized Finance), NFTs, and especially the tokenization of real-world assets (real estate, art, etc.) represent structural growth opportunities for years to come.

- Financial Products: The massive success of spot Bitcoin ETFs strengthens the legitimacy of the entire asset class and opens the door for new financial products based on other cryptocurrencies, which will attract even more traditional capital.

In summary, Bitcoin’s new ATH is a pivotal moment. It calls for more disciplined portfolio management and encourages smart diversification, all while creating exciting new opportunities beyond Bitcoin itself.

What’s the futur for the crypto ?

Regulation and Taxation: Can the Rules Keep Up?

As Bitcoin and the crypto market mature, one of the most important topics is regulation. Clear rules are essential for protecting investors, building trust, and allowing the industry to grow safely. However, right now, the world’s major economic blocs are taking very different approaches.

Europe Takes the Lead with MiCA

When it comes to crypto regulation, Europe has clearly taken the lead. The new “Markets in Crypto-Assets” (MiCA) framework, which came into full effect at the end of 2024, creates a single, unified set of rules for the entire European Union.

In practical terms, this is a huge step forward. Crypto companies can now get a single European license, which allows them to operate across all member states. Furthermore, MiCA establishes strict requirements for investor protection, market transparency, and the oversight of stablecoin issuers. The main goal is to make the crypto market safer and more credible, which in turn encourages both innovation and institutional investment.

The United States: A Patchwork of Uncertainty

The situation for crypto regulation in the USA is the complete opposite. The market there remains fragmented and confusing, with no single set of federal rules.

Different government agencies, like the SEC, often have conflicting views on whether a crypto asset is a security or a commodity. As a result, this creates significant legal uncertainty for businesses and investors. While the current administration seems to lean towards deregulation, the lack of a clear framework continues to hold back the industry’s full potential in the US.

A Note on Taxation

Alongside regulation, tax rules are also evolving. For instance, in Europe, bitcoin taxation in France for 2025 and other countries is becoming more defined. Gains from crypto are generally subject to tax, but the specific rules are constantly being updated. This means that while there are opportunities for smart tax planning, investors must also be very careful to stay compliant to avoid penalties.

In conclusion, Europe is creating a secure and predictable environment for crypto to grow, while the US remains stuck in uncertainty. This evolving regulatory landscape is designed to bring more stability and trust to the market, but it also requires investors to stay informed and vigilant.

Conclusion: So, Is Crypto a Good Opportunity Now?

After our deep dive into Bitcoin, the natural next question is: what about the crypto market as a whole? The answer is that yes, the crypto space represents a significant opportunity in 2025, but it is one that comes with important risks that every investor must understand.

On the one hand, the case for crypto is stronger than ever.

- First, institutional adoption is expanding beyond Bitcoin. While Bitcoin is the main entry point, major financial players are now exploring Ethereum, Solana, and other assets, which boosts the entire sector’s credibility and liquidity.

- Furthermore, the pace of real innovation is accelerating. The industry is rapidly moving beyond pure speculation and into real-world use cases with advancements in decentralized finance (DeFi), blockchain scalability, and the tokenization of assets.

- Finally, in an uncertain global economy, the crypto asset class is increasingly seen as a modern hedge against inflation and currency debasement.

However, it is crucial to be clear-eyed about the challenges.

The crypto market remains extremely volatile. Sharp price swings are a normal part of its cycles, and investors must be prepared for significant corrections, even in a bull market. In addition, the regulatory landscape is still evolving, especially in the US, which creates an unpredictable environment for both companies and investors.

Final Recommendation

In conclusion, the crypto sector offers substantial opportunities in 2025, driven by technological innovation and growing mainstream adoption. But it is not an area for short-term, risk-averse investors.

The best approach is one of caution, diversification across different crypto-assets, and a long-term perspective. For investors who understand these risks and have a multi-year time horizon, allocating a small, well-researched portion of a portfolio to the crypto space remains a compelling high-growth opportunity.