Introduction

Groupe Guillin is a leading French provider of thermoformed plastic packaging solutions, serving the food processing, catering, and retail sectors across Europe. Renowned for its specialized, innovative packaging products, the group is a vital supplier to food manufacturers, grocery chains, and fresh produce markets. With a history of resilience, steady growth, and strong visibility in essential packaging segments, Groupe Guillin stands out as a stable and attractive company—especially valued for its reliability and market focus in today’s uncertain economic environment.

Business Overview

Groupe Guillin offers a wide range of packaging products tailored to the needs of commercial catering, food retail, and fresh produce sectors. Its product mix includes:

- Trays and bowls: Used by supermarkets, bakeries, produce suppliers, and ready-meal producers for safe, hygienic, and appealing food presentation.

- Meal distribution carts: Designed for efficient meal service in catering, healthcare, and institutional environments.

- Plastic sheets: Utilized in the manufacturing of various custom packaging solutions.

- Sealer systems: Essential for securely closing food containers, optimizing freshness and extending shelf life.

The group operates through a network of specialized subsidiaries across Europe, enhancing both its reach and product expertise. Key subsidiaries include Alphaform, Dynaplast, and Guillin Emballages, among others. Each contributes unique capabilities and local market knowledge, enabling Groupe Guillin to serve a broad array of clients and remain agile in a competitive industry

Groupe Guillin – Financial Snapshot

- Revenue & Margins:

In 2024, Groupe Guillin reported revenue of €869.7million, with gross profit estimated at €472million (Reuters). - Profitability:

Net income for 2024 reached €59.7million. Profit margins remain stable, reflecting operational efficiency (Reuters). - Balance Sheet:

Total assets stood at approximately €961million, while debt continued to decline—from €159million in 2022 to €119million in 2024, indicating prudent financial management (Reuters). - Valuation & Key Metrics:

- Forward Price/Earnings (P/E): ~9.3×

- Price/Sales (P/S): ~0.65×

- Price/Book (P/B): ~0.89×

- Return on Investment (ROI): ~8.2%

- Return on Equity (ROE): ~6.4% (Reuters)

- Dividend:

Dividend yield is about 3.3%, with five-year dividend growth surpassing 27%, appealing to income-focused investors (Fintel). - Analyst View:

The average analyst price target is around €33.15, offering a potential 2% upside from recent levels. - Groupe Guillin demonstrates strong revenue generation, solid profitability, conservative leverage, and healthy shareholder returns, reinforcing its position as a stable, attractively valued player in the European packaging sector.

Growth Catalysts for Groupe Guillin

- Steady European Demand:

Demand for plastic packaging in essential sectors—such as food processing, retail, and catering—remains robust, sustaining the company’s core business and providing a resilient revenue base. - Strong French Base & European Diversification:

Groupe Guillin’s leadership in France, combined with its network of subsidiaries across Europe, supports both organic growth and market expansion opportunities in new regions. - Product Modernization & Value-Added Offerings:

Ongoing investments in modernizing packaging lines and introducing innovative products—like advanced sealer systems and multi-portion meal trays—help the group capture higher-margin business and respond to evolving client needs.

These factors position Groupe Guillin for continued growth, leveraging its essential market role and capacity for product innovation to reinforce its leadership across the European packaging industry.

Risks for Groupe Guillin

- Cyclical Exposure:

The company’s reliance on food service and retail sectors exposes it to economic cycles and industry restructuring, which could lead to fluctuating demand and pressure on sales. - Rising Raw Material and Energy Costs:

Increases in prices for plastics, raw materials, and energy may compress profit margins if not fully passed on to customers. - Competitive Pressure:

Groupe Guillin faces strong competition from major packaging conglomerates and global players with greater scale, which could challenge its market share and pricing power.

These risks require ongoing management focus to maintain operational efficiency, pricing discipline, and strategic positioning in a competitive and cost-sensitive industry environment.

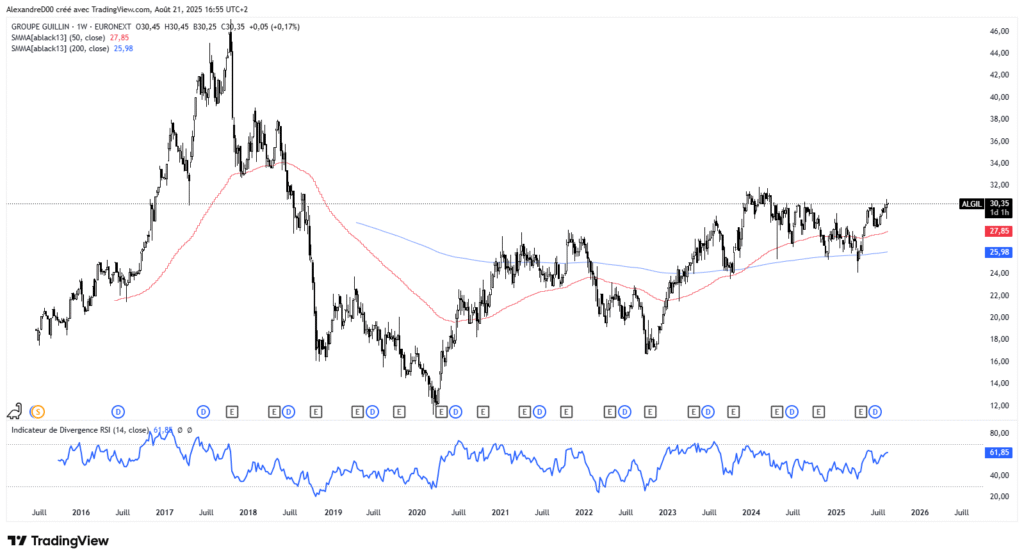

Technical Market Snapshot for Groupe Guillin (ALGIL)

- The stock is trading near its 52-week high range of about €30.80, currently around €30.30 (Reuters, Investing.com).

- Analyst coverage is limited, with moderately balanced sentiment reflecting a measured risk premium.

This trading pattern suggests relative strength and market confidence, though modest analyst attention may contribute to some price sensitivity.

Conclusion

Groupe Guillin presents a compelling investment opportunity by combining steady growth, solid profitability, and attractive dividend yield within a well-capitalized company serving essential sectors. Its modest valuation multiples offer a defensive profile with income generation and limited downside risk. This makes Groupe Guillin an appealing choice for long-term investors seeking stability and reliable dividend exposure in the European mid-cap landscape.