The World Today: A New Era of Global Tension

To understand today’s investment opportunities, it is first essential to look at what is happening in the world. Right now, we are living through a period of historic geopolitical tension. Indeed, the number of active conflicts is rising, new threats are emerging, and countries are investing more and more in their militaries.

This climate of uncertainty is pushing governments around the world to increase their military spending. For example, defense budgets are hitting record levels not seen in decades. This trend is fueled by the rivalry between major powers, but also by the need to modernize military equipment to face multiple threats.

A Global Snapshot: Who Is Spending the Most?

To truly understand the scale of this new era, it is helpful to look at the numbers. Global military spending has surged past $2.5 trillion, with a few key countries accounting for the majority of the budget.

Specifically, the United States continues to lead the world in defense spending, with a budget that surpasses the next ten countries combined. Following the US, China has solidified its position as the second-largest spender, consistently increasing its budget to fund a massive military modernization program. Meanwhile, Russia’s spending has also climbed significantly due to ongoing conflicts.

Here is a simple breakdown of the top military spending countries to put it all in perspective:

| Rank | Country | Military Budget (USD bn) | % of Global Budget | % of GDP |

| 1 | USA | 900 | 37% | 3.4% |

| 2 | China | 300 | 12% | 1.7% |

| 3 | Russia | 110 | 5.5% | 7.1% |

| 4 | Germany | 88 | 3.3% | 1.9% |

| 5 | India | 85 | 3.2% | 2.3% |

| 6 | UK | 81 | 3% | 2.3% |

| 7 | Saudi Arabia | 79 | 3% | 7.3% |

| 8 | Ukraine | 64 | 2.4% | 34% |

| 9 | France | 60 | 2.4% | 2.1% |

| 10 | Japan | 55 | 2% | 1.4% |

- The numbers are estimates and can vary depending on the source and the year of reference, but the ranking remains consistent.

- Ukraine’s exceptionally high % of GDP is due to the ongoing war.

- The global total for military spending in 2024 reached a record high of approximately $2.7 trillion.

Focus on Europe: A Dramatic Rise in Defense Budgets

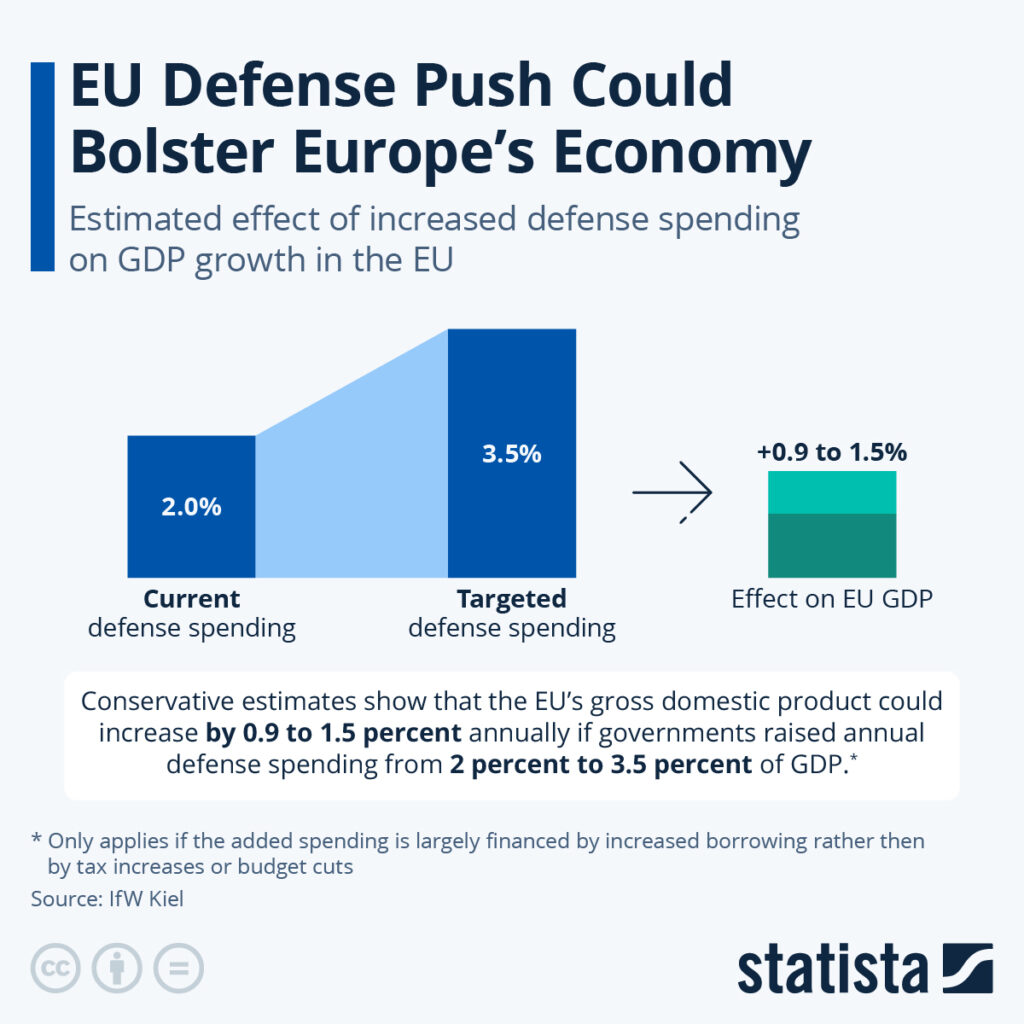

Europe is at the heart of this transformation. Facing an increasingly unstable security environment on its borders, the continent has made a major strategic shift.

In practical terms, European countries have massively increased their military spending. According to the latest reports, defense budgets in Europe have seen their sharpest annual rise since the end of the Cold War. In addition, the European Union has launched joint initiatives to purchase equipment and strengthen its own defense industry.

In other words, Europe is no longer relying solely on its allies to ensure its security. It is investing heavily to strengthen its own autonomy and its ability to defend itself.

In conclusion, this new era of high military spending and focus on security creates a very favorable environment for all companies operating in the defense and security sectors. This includes not only weapons manufacturers but also technology companies that provide essential solutions for national security, including in the field of healthcare.

How These Tensions Affect the Stock Market

This new era of global tension and military spending has a direct and powerful impact on financial markets. When geopolitical risks rise, investors change their behavior, which in turn causes predictable shifts in the stock market.

First, the most immediate effect is increased volatility. Unexpected events, like new conflicts or sanctions, make the future harder to predict. As a result, stock markets often experience short-term selloffs as investors react to the news. This “knee-jerk reaction” creates a choppy and uncertain environment.

Following this initial shock, we often see a “flight to safety.” This means that investors start selling what they see as risky assets, like high-growth technology stocks, and move their money into assets that are considered safer. For instance, traditional safe havens include gold and government bonds.

Just as importantly, this leads to a “sector rotation” within the stock market itself. Investors don’t just sell everything; instead, they rotate their money out of sectors that are sensitive to economic slowdowns and into more defensive sectors.

- Sectors that often suffer include consumer discretionary (like luxury goods and cars) and travel, as people spend less in uncertain times.

- Sectors that often benefit are those seen as essential or that are directly related to the new global priorities. This typically includes the defense sector, the energy sector (as supply can be disrupted), and, crucially, sectors related to national resilience and security, such as healthcare and biotechnology.

In summary, today’s geopolitical tensions are causing investors to prioritize safety, stability, and security. They are actively seeking out companies that can thrive even when the world is uncertain. This creates a powerful tailwind for businesses that operate in these key defensive industries.

The Investment Opportunity: Why the Defense & Security Sector Is in the Spotlight

Given this market environment, a clear investment theme emerges. As investors seek safety and stability, the defense and security sector is no longer a niche industry but has become a core strategic area for portfolios.

The reasoning is quite simple. When governments dramatically increase their military spending, that money flows directly to the companies that make defense equipment. Consequently, these companies are seeing a surge in orders and have a very predictable and growing stream of revenue for years to come.

Furthermore, this is not just about traditional equipment like tanks and planes. The nature of modern defense has expanded. Today, huge investments are being made in high-tech areas like:

- Artificial Intelligence (AI) for smarter weapons and analysis.

- Cybersecurity to protect critical infrastructure.

- Electronic Warfare and advanced communication systems.

Another key point is that defense stocks often act as a powerful hedge against market volatility. In other words, when geopolitical news causes other sectors to fall, defense stocks often hold their value or even rise, as investors understand that the need for security increases in uncertain times.

However, while the opportunity is clear, it is important to be aware of the risks. After the recent surge in performance, some defense stocks may now have high valuations. Therefore, careful stock selection and diversification remain very important for any investor.

In conclusion, allocating a part of an investment portfolio to the defense and security sector is now a well-supported strategy. The powerful combination of government support, technological innovation, and its defensive nature makes it a compelling choice for anyone looking for both stability and growth in today’s uncertain world.

Company in Focus: Exosens (EXENS.PA)

Within this booming defense and security sector, one European high-tech company stands out as a perfect example of this trend: Exosens. Formerly known as Photonis Group, this company is a world leader in the technology of detection and imaging.

What Exactly Does Exosens Do?

In simple terms, Exosens creates advanced technology that helps see and detect things in very difficult conditions. With over 85 years of experience, they are global leaders in their field.

Their core products are not consumer goods, but critical components that are sold to major defense, industrial, and scientific companies. For example, their products include:

- The core tubes that go inside night vision goggles.

- Advanced digital cameras for military and industrial use.

- Special detectors for nuclear power plants and scientific instruments.

- Power tubes for radar and defense communication systems.

In short, Exosens provides the essential “eyes” and “senses” for some of the world’s most advanced security and detection systems.

A Deep Dive into Exosens’ Financials and Future Growth

The company’s strategic position is clearly reflected in its outstanding financial performance.

| Matric | Value |

| Stock Price | €38.80 |

| Capitalization | €1.97B |

| Entreprise Value | €2.12B |

| P/E ratio | 24.6x |

| EBITDA | €118.5M |

| Net Income | €30.7M |

| Free Cash Flow | €55.4M |

| ROE | 4.9% |

| ROA | 16.16% |

To fully understand the investment case, let’s look at the company’s financial health and its trajectory for the future. The numbers reveal a solid foundation combined with a clear path for significant growth.

The Current Financial Picture

Here is a snapshot of the company’s key metrics today:

- Company Size: With a market capitalization of €1.97 billion, Exosens is a significant and well-established player in its high-tech industry.

- Current Profitability: The company is solidly profitable, generating €118.5 million in EBITDA and €30.7 million in Net Income.

- Valuation: The stock trades at a P/E ratio of 24.6x. In simple terms, this means investors are willing to pay about 25 times the company’s current annual profit for the stock, which reflects confidence in its future growth.

- Cash Generation: Exosens produces a strong Free Cash Flow of €55.4 million, which shows it has a healthy, cash-generating business model.

- Efficiency: The company’s Return on Assets (ROA) is an impressive 16.16%, indicating that it is very efficient at using its assets to generate earnings.

The Future Growth Trajectory

However, the most exciting part of the financial story is where the company is headed. Analysts have provided clear forecasts that show strong growth across the board through 2026.

Here are the key projections:

- Net Sales are forecast to surge.

- From €394 million in 2024 to over €519 million in 2026.

- Net Income is expected to more than double.

- From €30.7 million in 2024 to €84.3 million in 2026.

- Free Cash Flow is also set to increase.

- From €55.4 million in 2024 to nearly €70 million in 2026.

In conclusion, these projections paint a very clear picture. Exosens is not only financially healthy today, but it is on a path to accelerate its growth and become significantly more profitable in the next two years. This powerful financial outlook is a core reason why the company is attracting so much attention from investors.

The Investment Opportunity: Why Exosens Shines Now

All of this leads to a very compelling investment case in today’s market.

First and foremost, Exosens’ products are in extremely high demand due to the surge in European defense spending. This isn’t just a forecast; it’s happening now. To give a concrete example, the company has secured a major contract to deliver 25,000 night vision tubes to the German military, with most of those deliveries happening in 2026. This provides a clear and predictable source of revenue.

Another key point is that Exosens is a technology leader. Its night vision and digital imaging products are essential for modernizing land forces and are widely used by NATO militaries. This leadership position in critical technology creates a strong competitive advantage.

As a result, Exosens offers a very resilient investment. Government defense contracts are stable and less sensitive to economic cycles. Therefore, in a time of global uncertainty, the company’s business is more reliable than many others.

Conclusion: Is Exosens a Good Investment?

After breaking down all the different parts of this story, from global politics to the company’s financial numbers, our conclusion is very clear.

To sum up, the case for investing in Exosens is exceptionally strong:

- First, it is perfectly positioned in the right sector at the right time. The company operates in the defense and high-tech security market, which is experiencing a powerful, long-term growth cycle driven by a global focus on national security.

- Furthermore, it is a true technology leader. Exosens isn’t just a manufacturer; it provides critical, high-margin components like night vision tubes that are essential for modernizing NATO and allied militaries. This gives them a strong competitive advantage.

- Finally, its financial performance is outstanding. The company is not only growing its sales at a rapid pace, but its profits are projected to more than double in the next two years. This shows a healthy, efficient, and well-managed business.

On the other hand, investors should be aware that the stock’s valuation already reflects some of this optimism. As with any company in this sector, its success is also tied to government defense programs, which can change over time.

Final Recommendation: Strong Buy

Therefore, even with these factors in mind, the powerful tailwinds far outweigh the manageable risks. The combination of a booming market, clear technological leadership, and outstanding financial momentum makes Exosens a rare find in today’s market.

For investors looking for a high-growth company that is also supported by a defensive and non-cyclical business model, Exosens represents a Strong Buy. It is well-positioned to deliver significant value as it continues to capitalize on the global surge in defense and security spending.