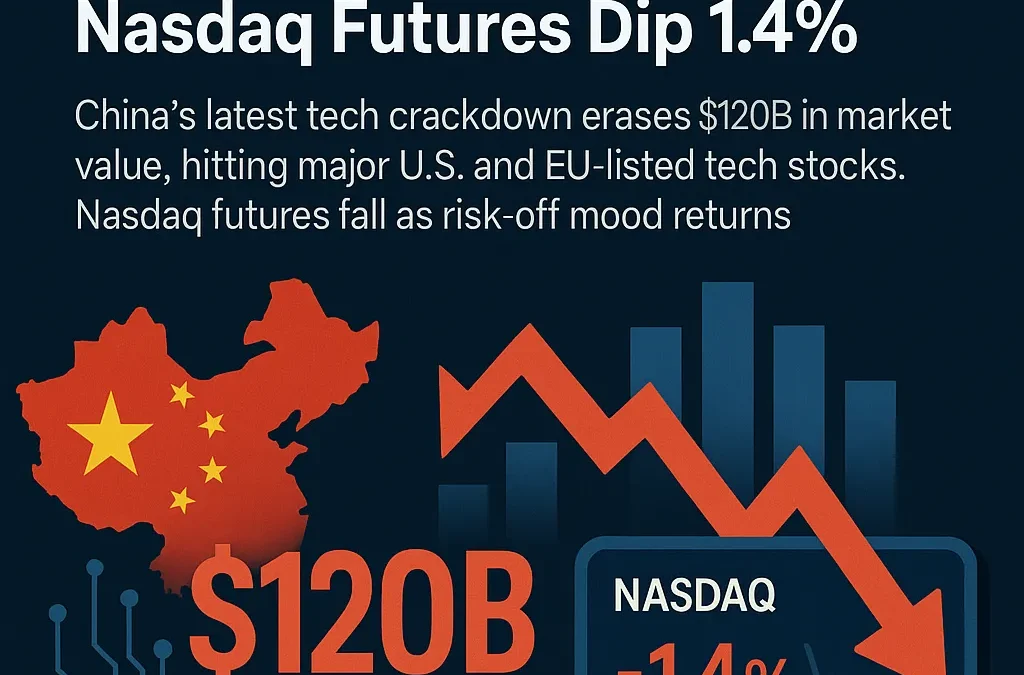

China’s Tech Crackdown Wipes $120 Billion: Nasdaq Futures Dip 1.4%

Global markets are once again rattled by renewed regulatory actions from China, targeting its domestic technology giants. The Chinese government’s intensified crackdown has wiped over $120 billion in market capitalization from major tech firms such as Alibaba, Tencent, Baidu, and JD.com within 72 hours. The effects have rippled across global stock exchanges, especially in the U.S. and European tech sectors.

What Happened?

Beijing unveiled a new set of data governance and foreign listing restrictions under its National Data Security Law, sending shockwaves through investor circles. The revised policy aims to impose stricter scrutiny on companies that collect large volumes of consumer data, particularly those listed or seeking listings abroad.

This new regulatory move builds on years of tech crackdowns that have included:

- Ant Group’s failed IPO in 2020

- Gaming restrictions targeting Tencent

- Monopolistic investigations against Alibaba

- Censorship and data compliance for social media platforms

Global Market Reaction

Nasdaq Futures Slide 1.4 % (Down)

The Nasdaq Composite Futures fell by 1.4%, while the S&P 500 Futures dropped 0.6% in early trading. The sell-off began during Asia’s trading session and quickly spread to Europe and the U.S. pre-market hours.

European Tech Stocks Also Hit

Key tech-related equities in Germany, France, and the UK also reacted negatively:

- Darktrace (UK): ▼ 1.9 %

- SAP (Germany): ▼ 1.2 %

- ASML (Netherlands): ▼ 2.4 %

U.S. and European Stocks With China Exposure

Many U.S.-listed firms with direct or indirect exposure to China also suffered losses:

- Apple (AAPL): ▼ 1.1% due to China supply chain dependence

- Tesla (TSLA): ▼ 1.5% with major factory operations in Shanghai

- Nvidia (NVDA): ▼ 2.8% as chip sales to China face renewed regulatory hurdles

Investor Sentiment and Safe-Haven Shift

With market uncertainty spiking, investors moved into safe-haven assets:

- Gold prices rose 0.9%

- U.S. Treasury yields fell as investors sought bonds

- The U.S. Dollar Index (DXY) climbed 0.5%

Meanwhile, VIX (volatility index) jumped by 12%, highlighting the heightened risk sentiment.

Broader Tech Sector Risks

This latest crackdown highlights growing geopolitical and compliance risks for Western investors holding Chinese tech stocks or multinationals heavily exposed to China.

Key concerns include:

- Delisting risks for Chinese companies on U.S. exchanges

- Slower revenue growth for U.S. firms operating in China

- Cross-border data transfer restrictions

- Currency and trade war spillover effects

Long-Term Market Implications

As China moves toward data sovereignty and tech independence, foreign investors may see:

- Lower earnings outlooks for U.S.-listed Chinese ADRs

- More regulatory costs for EU tech firms operating in Asia

- Shifting tech investments from China to India, Vietnam, and Southeast Asia

Conclusion

This will impact the Global tech Giants lead to Global losses to Tech companies which are in connection to these and are having the Investment from the same.